Marco Hegglin

Head Business Management

- Telefono:

- +41 58 283 55 86

Pubblicato il 19.11.2019 TEC

As a partner in the proof of concept study, Vontobel is setting a further milestone for future securities settlement via DLT.

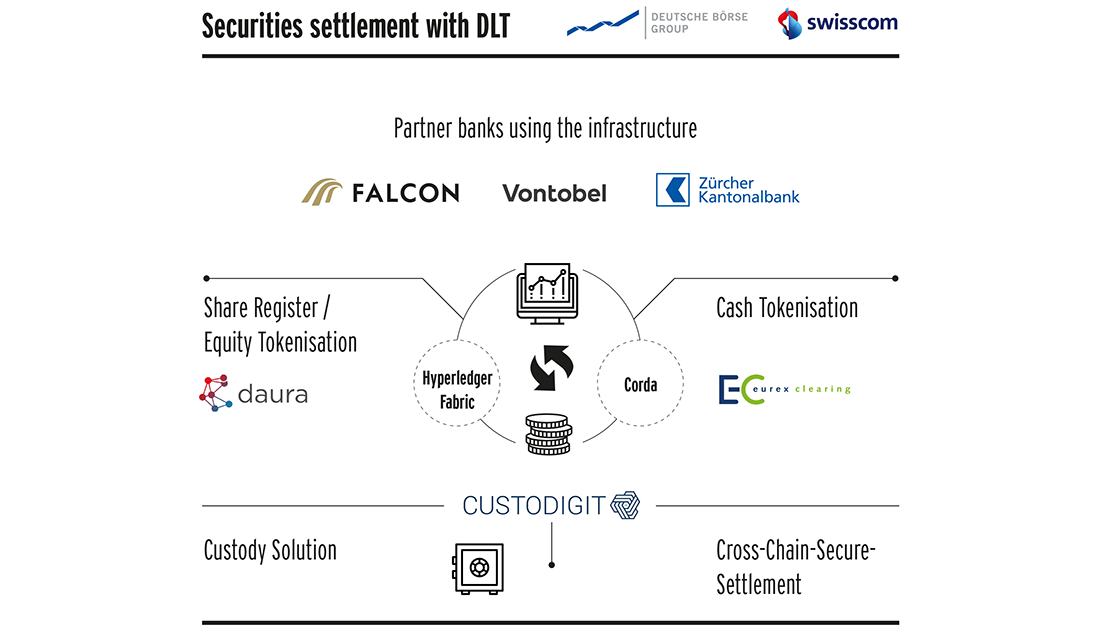

As one of the three banking partners in the feasibility study which was orchestrated by Deutsche Börse and Swisscom, Vontobel, Falcon Private Bank and Zürcher Kantonalbank successfully settled securities transactions with tokenised shares and tokenised cash using DLT.

With this initiative, the partners are using legally binding transactions to demonstrate what an immediate and safe securities settlement of shares using DLT can look like.

Shares of a Swiss company tokenized

As part of these transactions, the share register of a real Swiss company was digitized via the daura platform and the company's shares were tokenized.

In order to be able to execute a delivery versus payment (i.e. Lieferung-gegen-Zahlung as LgZ) transaction based on DLT, Deutsche Börse issued tokenized cash in Swiss francs via its subsidiary Eurex Clearing. The FIAT money deposited by the participating banks was deposited on the Eurex Clearing account with the Swiss National Bank as collateral.

In the subsequent transactions, Vontobel acted as counterparty and exchanged the two tokens to fulfill the transactions.

Two different DLT protocols (Corda and Hyperledger Fabric) were used for the cash and equity sides. A special process ("cross-chain-secure-settlement") was used to ensure that none of the parties had to pay in advance.

Vontobel follows a client-centric digital business model and offers its clients compelling solutions while diligently managing risks. Already since 2016, Vontobel offers - as the first bank worldwide - certificates on Cryptocurrencies, thereby making crypto currencies bankable and tradeable on regulated exchanges. In January 2019, Vontobel extended its service offering by providing a digital asset custody solution for regulated third parties, the Digital Asset Vault (DAV). Later in 2019, Vontobel issued the first structured product in form of a security token on the Ethereum blockchain.