Managed solutions

At Vontobel, we manage your assets not only actively but proactively. To do this for you successfully, we call upon the proven expertise of our in-house research teams, craft specific investment ideas, and propose solutions especially developed for you

Our work centers on you

Your choice

Investing by means of a mandate solution allows you to keep the big picture in view – and in the easiest possible way. To ensure that you always have the agility and flexibility you need, all of our mandates can be tailored to your individual requirements and expectations.

Your freedom

You make one decision – after that, it’s us who stay on the ball for you. With our experts taking care of optimizing your investments, you yourself are freed from the need to make day-to-day decisions. Short and sweet: You have more time for the important things in life.

Your advantages

Vontobel reacts quickly and effectively to changes and opportunities in the market that can be realized via your mandate. And since your mandate provides full transparency into its performance, you can see and follow what is happening at any time.

Our mandates

Investors aiming to achieve performance on par with the market itself often rely on passive index strategies such as those offered by ETFs. Our aim is to outperform the market – and to do so with a comparable degree of risk. That’s why our philosophy at Vontobel is to operate as an active investor.

At Vontobel, you can recognize active investing by the Vontobel 3α Investment Philosophy®. It aims to generate the famous “alpha” from three sources of return: through diversification, by making investments based on strong convictions, and by identifying individual opportunities. For your benefit, we combine this approach with our other core competencies to create multi-asset Vontobel 3-alpha asset mandates.

Would you like to invest in individual, sustainably successful companies? Our Specials mandates give you this opportunity, supported by our equity research and a quality approach we adhere to strictly.

We offer Specials mandates in these areas

- Swiss equities

- European equities

- US equities

- Global equities

- Global dividend achievers

- Global bonds

Make asset class-specific investments in equities or bonds

This mandate offers a robust portfolio that invests in global bond and equity markets. Alternative investments can also be included. The mandate is implemented by making a selection of indexed and active investment instruments. In addition, investors benefit from investment products we have developed in-house, which among other approaches invest in stock markets using “smart indexing,” an effective index strategy. The Diversifier mandate provides solid diversification not only across asset classes, but also across regions, sectors, and types of investment instrument.

Vontobel Diversifier offers you the following advantages:

- Broad diversification

- Long-term orientation

- Mix of passive and active investment instruments

Allocation by asset class

Diversified, efficient investments in global capital markets

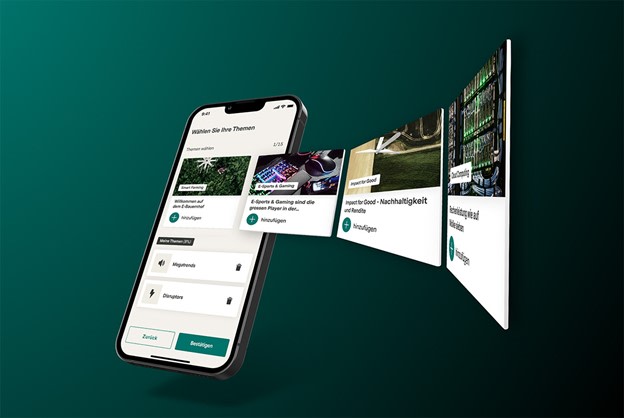

A discretionary investment solution based on dynamic asset allocation, providing access to quality and growth strategies executed in global financial markets and in line with attractive investment themes (e.g. megatrends).

This mandate offers you a global portfolio that invests in assets Vontobel considers particularly convincing. It follows the tactical decisions of our Investment Committee regarding asset allocation, while the assessment of individual investment opportunities is based on the expertise of Vontobel’s in-house economists and strategists. In the equities area, the focus is on quality shares with high market potential. In addition, we invest in line with high-potential megatrend themes, identifying target companies that should benefit from structural growth. The mandate is implemented by means of passive and active funds.

Vontobel Conviction offers you the following advantages

- Dynamic asset allocation

- Attractive, blue-chip companies

- Megatrends

Allocation by asset class

Diversified, efficient investments in global capital markets + targeted convincing investments

A discretionary investment solution offering exclusive access to the global financial markets, making use of all sources of return

This mandate offers a global portfolio that invests in line with highly convincing, broadly diversified themes (blue-chip equities and megatrends) as well as in short-term market opportunities. Its focus is on future-oriented companies that are tackling significant challenges and can therefore represent significant investment opportunities. On your behalf, the mandate makes use of our independent, in-house research capabilities and even applies artificial intelligence to the task of identifying attractive return opportunities. Encompassing a broad investment universe, your portfolio would include passive and active funds, individual equities, and alternative investments.

Vontobel Opportunities offers you the following advantages:

- Dynamic asset allocation and broad diversification

- Robust risk management

- Exploitation of short-term market opportunities

Allocation by asset class

Diversified, efficient investments in global capital markets + targeted convincing investments + specific market opportunities

In addition to multi-asset portfolios, Vontobel also offers mandates with a clear focus. In the equities area, the focus is on blue-chip companies with high market potential. In the area of bonds, we make use of both direct investments and funds.

A discretionary investment solution with easy access to global financial markets

| Equities Switzerland | |

| Equities EMU | |

| Equities global | |

| Dividend achievers global | |

| Bonds global |

Vontobel Specials offers you the following advantages:

- Special focus

- Direct investments

- Active portfolio management

Any questions?

Pascal Ramseier, Head Client Portfolio Management, on Vontobel’s investment focus

“We are convinced that we can create value for you by actively managing your assets.”

A discretionary multi-asset mandate

Active portfolio managementComprising a selection of blue-chip equities and price-efficient funds, your portfolio is professionally designed, managed, and monitored |

Dynamic asset allocationYour asset allocation is consistently revised, in line with the guidelines of our Investment Committee. Then, potential individual investments are assessed based on the expertise of our in-house economists and strategists |

Investment decision and tradingOnce the investment decision is made, the corresponding trades are placed immediately for your portfolio |

DiversificationMulti-asset portfolios are optimally composed, very broadly diversified portfolios that are managed according to a structured investment process |