Investment ideas capturing the Zeitgeist of today – and tomorrow

Megatrends

Don’t be taken by surprise by trends that were foreseeable. Instead, integrate trends into your portfolio using a systematic approach.

Megatrends in the context of your investment portfolio

In contrast to a hype or a crash, Megatrends do not come about because the markets happen to be in a particular “mood”. That is why the Megatrends of 2020 will be the same as the Megatrends of 2021, and 2030, and so on into the future – because Megatrends are currents that have to meet three conditions.

Find out more about Megatrend Investing and the Megatrends Model that Vontobel uses.

Megatrends bring the big picture into sharper focus

For around ten years now, changes have been emerging that are permanently affecting all of our lives. These are the so-called “Megatrends”. What they have in common:

- They remain relevant for 25 to 30 years.

- They have an impact on every area of our lives.

- They trigger global shifts.

The four Megatrends on the Megatrends Map

The main themes:

- Artificial Intelligence & Big Data

- Robotics & Automation

- Internet of Things (IoT)

- Digitization

New digital technologies are changing the world as we know it. Modern companies will experience this Megatrend in every area of their operations, driven by advances in Cloud computing, Big Data, artificial intelligence (AI) and the Internet of Things (IoT). These changes are affecting FinTech companies just as much as e-commerce and the healthcare sector. In medicine, digitization has led to faster and more accurate diagnoses. But improved medical treatments and gene therapy are resulting from digital progress as well.

In the automotive industry, digital technologies have accelerated the spread of electric vehicles (keyword: e-mobility) and the development of self-driving cars. Robotics as we know it today would be unthinkable without innovations in automation and AI. More and more, robots are able to take on tasks that previously could only be carried out by humans.

This Megatrend will affect all aspects of the economy, boosting productivity and economic growth, as modern companies will continue to use new technologies to their advantage – in compliance with the given legal and regulatory framework, of course. They will allow these firms to keep up with the competition, or be ahead of it.

The main themes:

- Environment

- Social issues

- Corporate governance

- Impact-oriented value creation

The transformation of the economy towards greater sustainability is in full swing. Almost every listed corporation today is pursuing the strategy of achieving its goals sustainably. That means doing business in an environmentally friendly and socially sustainable way, while fulfilling the principles of good corporate governance. There are good reasons for this: Companies without such a strategy are often penalized on the stock exchange. For many investors, compliance with ESG standards (i.e. Environmental, Social, and Governance principles) is increasingly becoming a relevant factor in their investment decisions.

As a Megatrend, sustainable value creation will not only stimulate innovations in areas such as energy generation, mobility, and recycling, but will also help create various new investment styles for private investors.

The main themes:

- Rise of the emerging markets and the so-called "frontier markets”

- Emerging trade tensions

- Race for global resources

- Race for technology leadership

The new multipolar world order is taking shape with new competitors – and new consumers. For one thing, the United States of America is facing increasing competition and is no longer the undisputed world power it once was. This new competition is manifesting itself not only politically, but also in economic terms.

On the economic level, the US is being confronted with the rise of China. But India also has ambitions to significantly advance its economy. Economic development in these two countries, the most populous in the world, is representative of the potential of the emerging markets.

On the other hand, technological developments are confronting the economic powers with new challenges. These include the ever-increasing networking of computer systems and devices, the unrelenting growth in the flow of data, and threats from radical forces such as hackers. This Megatrend systematically considers all these factors.

Read as well our white paper on this subject: USA vs. China: “The Next Digital Superpower”

More and more, human society is based in cities. And it is getting older. Physically and mentally, the older generation is enjoying ever better fitness these days, active in a variety of ways and enjoying a high level of material security up to a very old age.

The term “best ager” sums it up. As developed economies age rapidly, however, healthcare costs will take up a larger share of private and government spending. Innovative companies that provide technologies and new solutions to enable better care at lower costs are in the "sweet spot" of this development.

The focus of this Megatrend is also the changing consumer behavior of younger people (Gen Z), which is the driver behind the development of new trends such as e-sports & video gaming.

“Megatrends are like continental plates: moving without cease, and independent of any particular event.”

Current issue: Megatrends in the Coronavirus age

The Coronavirus pandemic was an unexpected catalyst for Megatrend models. It has not only shown that the model remains of interest for investors. On the contrary, COVID-19 has confirmed the Megatrends in terms of their relevance and robustness.

Discover four areas where the Megatrends have been confirmed.

The Coronavirus and the Megatrend “Technological change”

The effects of accelerated technological change were particularly felt in the new work-from-home boom. Hardly a single news portal failed to offer “tips for working efficiently at home” or to report on the joys of the virtual after-work drink with colleagues. But outside of the world of work, too, the pandemic accelerated the process of digitization in diverse areas of our lives, from video phone calls to online shopping to food delivery.

At least as significant as these changes, however, was the way Big Data and artificial intelligence (AI) became the backbone of pandemic control. With contact tracing apps, the world experienced an unprecedented degree of connectivity. Smartphone manufacturers updated their devices practically overnight in order to exploit the possibilities of Bluetooth technology. And the World Health Organization (WHO) set up a digital platform (C-TAP) in May 2020 that bundled research results for treatment and diagnostics.

The Coronavirus and the Megatrend “Sustainable value creation”

At a stroke, the world's aircraft fleets were in effect grounded in the spring of 2020. At the same time, we experienced a never-before-seen return to a more local focus – in our private lives as well. Thanks to empty supermarket shelves, the issue of local food sources took on a new urgency, as did the need for more sustainable supply chains. While politicians were putting together the first rescue packages at record speed, there were calls that these funds should (also) be used for the sustainable transformation of the economy.

Planned energy and climate investments are, in a word, “considerable”. Around the world, around 18 trillion dollars are being made available, divided between:

- the “Green New Deal” (USA, 2 trillion),

- the “European Green Deal” (1 trillion)

- and China's Climate Neutrality Plan (15 trillion by 2060).

The Coronavirus and the Megatrend “Multipolar world”

COVID-19 has shown the world how fragile the current geopolitical balance of power is. In the power poker played by the world powers, the pendulum swung from a euphoric “we’re all in this together” attitude to one of resolute opposition – and back again. On the one hand, governments made it possible for their research institutions to collaborate across borders in vaccine development on an unprecedented scale; on the other hand, they outdid each other with accusations relating to the origin of the pandemic and, most recently, the distribution of vaccines.

The Coronavirus and the Megatrend “Demographics and urbanization”

The calls for “social distancing” made us realize how densely populated the cities are that we live in and how vulnerable our aging society is – a fact that even before the pandemic could hardly be hidden any longer, but was now out in the open for all to see.

As hubs of human interaction, large cities were hit hard by the effects of COVID-19. In the wake of the uncertainties this created, the need to transform these urban concentrations to smart cities has become clearer than ever. Networked healthcare will also play a role here, as will new urban mobility concepts.

We study Megatrends to create investment guidance:

“Defining investment themes to navigate through a world of transformation.”

Megatrends reduce complexity

Whether it’s robotics, or wind energy, the crux is always the same. You pick up an investment topic in the media that is currently making headlines. But how does this supposed investment opportunity or share fit into your overall portfolio? An example:

Focusing on opportunities in the right place

Having an understanding of, and a “feel” for, a stock market is essential if you want to enrich your portfolio by means of thematic opportunities.

The Megatrends Model supports investors by allowing them to systematically integrate their personal know-how into the context of their portfolio – even in markets they may not be familiar with.

We call this: “Adapt and thrive”. Is your portfolio ready to turn changes into opportunities?

Even the smallest undertaking starts with a conversation

FAQ: Frequently asked questions about Megatrend Investing

We answer the questions our experts are most frequently asked in connection with Megatrends and Megatrend Investing.

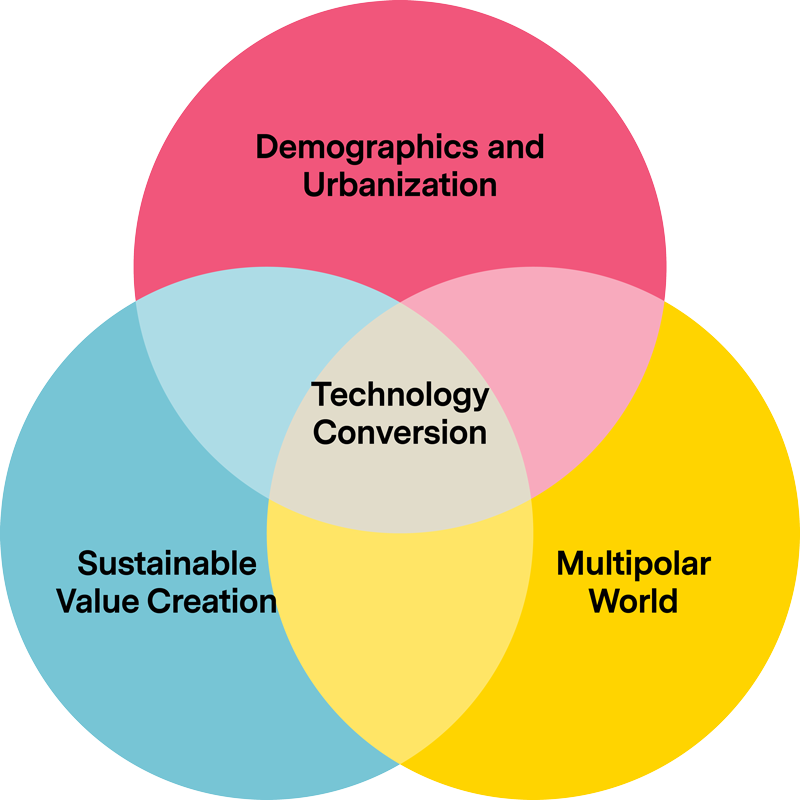

I've also seen models that integrate three, five or seven Megatrends. What is the advantage of the Vontobel model with its four Megatrends?

The aim of the Megatrends Model is to keep an eye on the future – an ambition that has always motivated investors. In doing so, however, one challenge is always the same: The more individual Megatrends you observe, the harder it is to see the overall big picture. On the other hand, if you are following too few aspects, you may miss important interrelationships.

Our experience has shown that following four Megatrends is best for identifying and evaluating investment opportunities.

“Simple rules of thumb have proven to be more effective than complex models for capturing changes efficiently.”

If I differentiate between trends and Megatrends, what is my advantage?

“That’s a big trend now!” You often hear or read this statement, the point being to present something as desirable: something that you absolutely should have (i.e. buy). There is nothing wrong with that, but this kind of trendiness may not be far from hype, and it is associated more with short-term opportunities.

“In contrast to Megatrends, trends are mostly entertaining diversions.”

The Zeitgeist can take a different turn at any moment. Anyone thinking further ahead than just a few months or years when investing should make the distinction between trends and Megatrends. The Vontobel model helps you do this.

Am I already too late if I start investing in Megatrends now?

Generally speaking, no. That’s because these Megatrends didn't just begin today – and they won't end tomorrow. The model is designed in such a way that the point in time is not a priority. Instead, thematic aspects come to the fore.

The question of timing is important, however, in the context of your personal portfolio. As it is currently set up, is your portfolio properly diversified and aligned in order to be able to take on the additional risks and opportunities that thematic investing will present? To be sure, the best thing to do is contact our Megatrend experts.

Should I expect that the four Megatrends will change as time goes by?

In principle, no. The Vontobel model with its four Megatrends is configured in such a way that it can also integrate trends occurring in the future into the existing Megatrends. We believe that each Megatrend will remain valid for 25 to 30 years. The Coronavirus pandemic unintentionally put this claim to the test: Even fundamental events such as a global pandemic have not called the relevance of the model into question (more on this in the text above).

Within the individual Megatrends, however, dynamics unfold that will lead to new investment opportunities – and this will happen over and over again.

Which of the four Megatrends will have the greatest impact on my investments?

|

The strength of our Megatrends Model lies in its ability to capture future changes as comprehensively as possible. This holistic view can only come about because of the interaction of the four Megatrends, meaning that a fundamental part of the model is the recognition that the Megatrends overlap. This is an intentional aspect of the model, because investment opportunities arise based on the dynamic of how the Megatrends overlap and how interaction between them plays out.

Technological change is the Megatrend that overlaps the most with the other three. Much of the progress and change that awaits us will only be made possible, or will be accelerated, by technological changes. Accordingly, the Megatrend “Technological Change” is at the center of our model and deserves the greatest attention from an investor's point of view. |

Why do I not find digitization as a Megatrend in the Vontobel model?

In its original definition, digitization refers to the digital representation, modification or execution of existing (i.e. analog) technologies and processes. From today’s perspective, this digital revolution (also called the “Third Industrial Revolution”) is only the beginning of a further, fourth revolution, often referred to in the media as “Industry 4.0”. Accelerated by artificial intelligence (AI) and Big Data, new fields of innovation are emerging that were previously unimaginable. That is why the broader term “technological change” is, to us, more apt.

The concept of sustainability is important to me. Am I not making a mistake here with Megatrend investing?

Sustainability – or “sustainable value creation” – is explicitly one of the pillars of our Megatrend Model. And for good reason: The sustainable transformation of our society and economy for future generations is in full swing. This will naturally lead to a historical asset reorientation. As a globally active investment company, we are aware that we have a responsibility towards our stakeholders to play an active role in this restructuring.

More on the subject of "sustainable investing"

| Please note the “Act ESG” watermark you will see on our website. This symbol signals our invitation to you to consider a sustainable investment opportunity and aims to help you make informed and active decisions concerning solutions in the area of ESG (i.e. those following Environmental, Social, and Governance principles). ESG solutions allow you to align investment decisions with your personal convictions, to ultimately drive positive change, for the world – and also for your returns. |

What is the difference between Megatrend Investing und Thematic Investing?

Put simply, Megatrends form the structured framework upon which Thematic Investing is based. Megatrend Investing and Thematic Investing are therefore not at odds with one another, but rather in pursuit of the same goal: to find companies that are not so much dependent on short-term economic cycles, but rather ones that will create value and generate higher returns in the long term.

An overview of our thematic investments can also be found here:

What do I need to understand by the technical term “Thematic Investing”?

Thematic Investing aims to capitalize on long-term trends that transcend economic sectors and geographic boundaries. Thematic strategies take into account the adaptation of companies to rapid change. In addition, “Thematics” include the drivers of long-term value creation and long-term risk.

Thematic research aims to understand converging innovations and is therefore always undertaken across sectors, industries, and markets.

Why is it worth adding thematic investments to my portfolio?

We believe that innovation and change are the keys to a company’s long-term growth in revenues and profits. Our mission is to achieve long-term capital growth in a way that has little correlation with traditional investment strategies.