We write αdvαntαge with “α” like “αlpha”

Vontobel 3α Investment Philosophy®

Our way to alpha sources of yields is called active management.

Three alphas when investing

Put in simple terms: the Vontobel 3α-Investment Philosophy®

Our Vontobel 3α Investment Philosophy® is based on the conviction that we can generate added value for you by actively managing your assets. The focus is on three sources of yields - also called alphas.

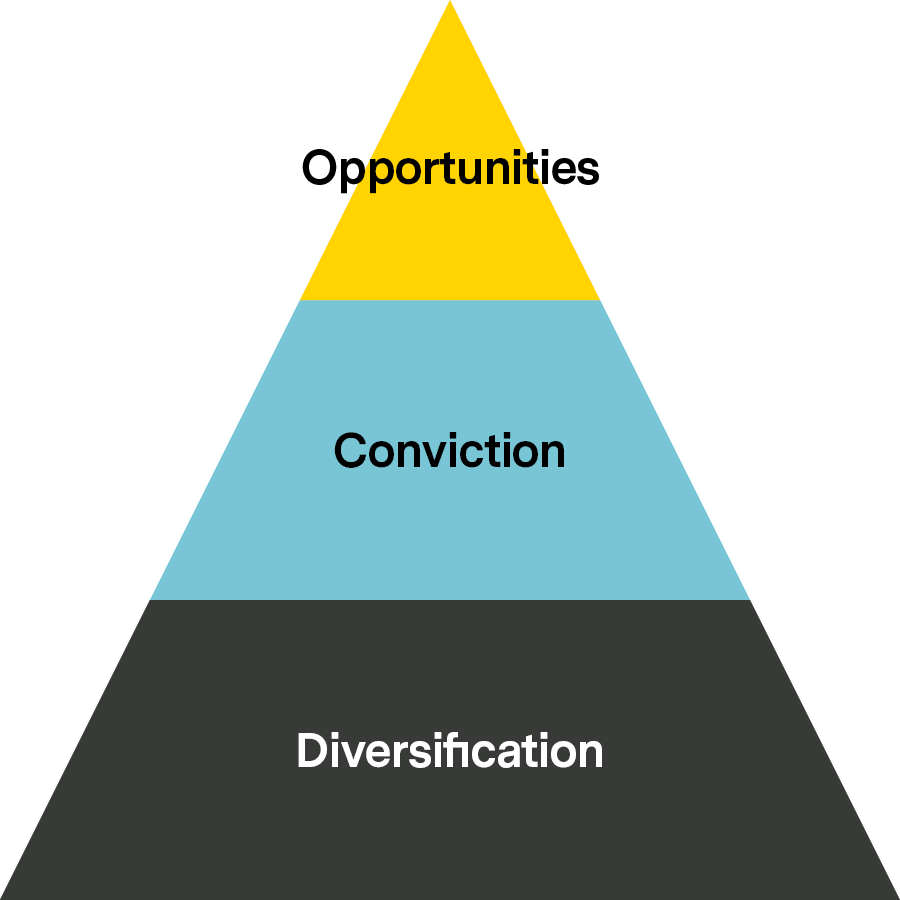

The 3α pyramid: flexibility at three levels

3rd alpha

Targeted selection, for example of individual equities. We add short-term opportunities to the portfolio and take advantage of the fact that the capital markets sometimes react strongly to news.

2nd alpha

Investments with high conviction. This includes economic changes such as macro- and megatrends. For equity investments, our long-term conviction lies in our “Global Quality Achievers” model, which focuses on the substance of a company.

1st alpha

A robust and broadly diversified portfolio is the foundation to be able to realize a value increase in the long-term. We rely on active management here as well.

Alpha vs. beta—here is the difference

The easiest way to explain the term “alpha” is to compare it to the term “beta.” Both terms describe the way an investor obtains yields in the financial markets.

- Beta (β) is generally described as “market return.” It is what financial markets yield in terms of returns without requiring any special skill or knowledge. Or, in other words: Beta is the premium that you receive for buy-and-hold, for example in a classical 60/40 portfolio. Investments in the MSCI World Index or another broad investment index are common in this context.

- In contrast to this, alpha (α) is additional income. Alpha sources of return are generated by active management in addition to the market return or beta. Alpha is important because returns can be generated over the course of time from the interest effect of this additional income, which would not be possible - or only be possible with difficulty - with a pure market portfolio.

With the Vontobel 3α Investment Philosophy®, we are pursuing the goal of realizing this alpha at three portfolio levels: strategically at the “diversification” level, thematically and tactically at the “conviction” level and in connection with individual equities at the “opportunities” level. For this reason, we operate as an active manager at all three levels and favor active portfolio management.

The three alphas at a glance

Active investment management in practice

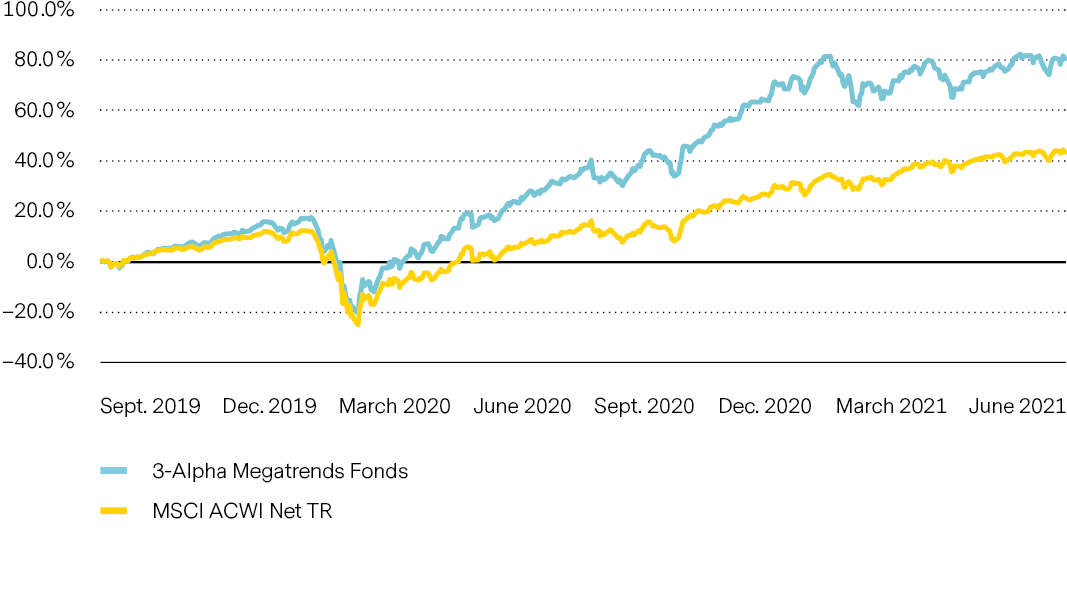

Comparison: The performance of the “Vontobel Fund II – Megatrends”1 and the MSCI ACWI Net TR

1 Previously named “3-Alpha Megatrends Fund”

© Vontobel Asset Management, source: Vontobel, MSCI

Comparison period: September 2019 to June 2021. The MSCI ACWI Index was launched in January 2001. It tracks large and medium-sized companies from 23 industrial countries and 27 emerging markets. With 2,964 constituents, the index covers around 85 percent of the worldwide, investable stock possibilities.

Past performance is not a measure of future performance. The performance data does not take commissions or costs into account, which are collected when shares are issued or redeemed. The funds’ yields may rise or fall since exchanges rates between currencies change.

Yields and risks at a glance

Optimized for long-term investments

Various investment opportunities are available to you depending on how heavily you want to use individual sources of yields. We invest in a risk-conscious way. We evaluate your portfolio diversification across multiple asset classes and the risks of individual investments in your portfolio using the “value-at-risk” approach¹.

With this type of risk monitoring, you benefit from a more flexible implementation of your investment targets and receive more transparency about the risks that your investment strategy is based on. We also show counterparty risks in your portfolio in a way that is appropriately simple and clear.

Our risk assessment is completed by scenario analyses. Using these analyses, we will show you how past crises would have influenced your portfolio.

Our risk engine, which we developed ourselves, covers all asset classes with more than 450,000 instruments and calculates risk, taking around 140 risk factors into account. In only a few milliseconds, the overall risk can be calculated for an average portfolio with around 20 positions.