Fintech on a roll – but it’s not just about technology

Publié le 19.11.2019 HNEC

Opening an online account with just a few mouse clicks, using an app to transfer money from one mobile phone to another: what used to be the stuff of science fiction is now reality. Much of the technology was created by “fintechs”, many of them established entrepreneurs who not only stand out due to their banking expertise and visionary thinking, but often also because of their youthful charm. After the initial euphoria, the industry tends to consolidate and the more established financial institutions ride the trend by introducing their own solutions.

Fintechs – the abbreviation combines “financial services” and “technology” – are not only creative when it comes to applying new technologies. They also tend to have most of the bright ideas for attracting potential clients by highlighting environmental issues or through skillful use of social media. But they all have one feature in common: their personalized solutions capture the zeitgeist. And even better: they relieve users of problems that they may have been totally unaware of previously.

Only a few “unicorns” in Europe to date

Young fintechs are becoming more and more attractive for investors as well. These start-ups raised more than 39 billion US dollars worldwide in 2018, almost five times as much as in 2014. The global herd of "unicorns" – companies valued at more than one billion US dollars on the stock exchange – now has 39 fintechs. The pastureland in Europe, on the other hand, is much less productive, with only five unicorns1 grazing on it.

The trend towards digitization is likely to continue. While in 2007 only a quarter of all bank clients in the European Union managed their money electronically, by 2018 this figure had risen to more than half. Every second customer aged between 16 and 74 now banks online2. More people are also switching to mobile apps as well, as they want to be able to carry out bank transactions while on the move.

Technology much admired – but is the business plan sound?

This positive development makes the environment more challenging for fintech companies. Facing tougher competition, they have to fine-tune their products in order to stand out in the market. Meanwhile, the technology continues its relentless advance. The buzzwords are blockchain, artificial intelligence, and automation. Customer loyalty is also essential. If, for example, a company does not keep to its business plan due to unexpected technological difficulties, it is quickly punished on the stock exchange. But not all routes to success need to be digital: some young companies have shown their ability to make an impact on the market through regular surveys to get customer feedback.

If you can’t beat them, join them

Fintech came of age a long time ago. Established banking houses are also jumping on the digital bandwagon, so as not to be left behind. They want to avoid making the same mistake as the travel industry, for example, which was literally overpowered by Internet-based providers.3 They rely on their own know-how or collaborate with start-up companies to develop innovative products and services that facilitate transactions and asset management for bank clients. Such partnerships are generally beneficial for both sides: traditional financial institutions benefit from new approaches and technologies, while start-ups can close their own knowledge gaps, overcome regulatory hurdles more easily or compensate for clients’ wariness of a new company.

In future, this type of partnership could flourish in an “Open Banking” set-up4. This is where third parties are able to trigger certain transactions by using the original offering as a platform for their own products. This closer integration of traditional banking and other financial services offers bank customers more convenience and ease of use. Open banking is already practised on a voluntary basis. With the Payment Service Directive 2, an extended payment services directive of the European Union, the payments industry must be opened up to competition from non-banks on a pan-European basis. However, account holders must give permission to third parties to use their data.

Breaking into new client segments

In an era of stagnant markets, shrinking margins, and people’s growing affinity for the Internet, innovations may be able to attract new clients. One area of private banking that could still be explored is the affluent segment, where client assets amount to between 250,000 and 1,000,000 Swiss francs. Their banks often find it difficult to meet needs that go beyond those of traditional private customers. Affluent customers expect transparent, solution-oriented advice and personalized offers. They want access to services at all times via all channels, but also value personal contact. The management consultant Deloitte estimates the value of assets owned by affluent clients in Switzerland at around 280 billion Swiss francs.5 This amount is likely to be several times higher in Germany. This is a rich seam for financial service providers to mine.

Emotional attachment – people matter

High-quality digital banking products and services create added value for clients and financial institutions. But it’s not always the use of the latest technology that is the sole measure of success: no business can survive unless it has a sharp eye for security aspects. The recent spate of attempted frauds at fintech start-ups show just how relevant the theme of security is6. It is also important to take account of changing customer needs on an ongoing basis. Involving customers in the development of solutions and continuing to offer them the opportunity for personal contact establishes an emotional tie with "their" bank. This bond is created by people, not technology.

We pay a great deal of attention to innovation inside Vontobel as well

For example, in the WM Digital Hub, an agile cross-functional team of relationship managers, digital marketing experts, developers, and project specialists is developing new digital solutions that are benefiting the entire bank. The initial impetus was MiFID II. Although it has the laudable goal of increasing investor protection and transparency, MiFID II also puts constraints on existing processes, with the result that Advisory is slower and more complicated.

Responding to this challenge, Vontobel designed the completely new, fully digital “MARS” platform. Now, a Vontobel relationship manager can select investment instruments from some 450,000 possibilities and calculate their impact on the client’s risk profile in real time. But the WM Digital Hub has many more irons in the fire as well. It is currently working on a variety of different projects, such as our digital wealth management tool Volt, and the further development of the existing digital solution VT Wealth.

Nimble fintechs challenge traditional banks

The latest upheavals in the financial services industry can legitimately be described as “disruptive”. What central banker would have dreamed years ago that the technology company Facebook would forge plans for a digital global currency called Libra? Fintech companies are also challenging the traditional banks, which focus on private customers. Nowadays, business ideas are rapidly turning into digital offerings. The financial sector can no longer afford to ignore services such as crowdfunding, crowdlending, Robo-Advisor, mobile payments, direct banking, or banking-as-a-service.

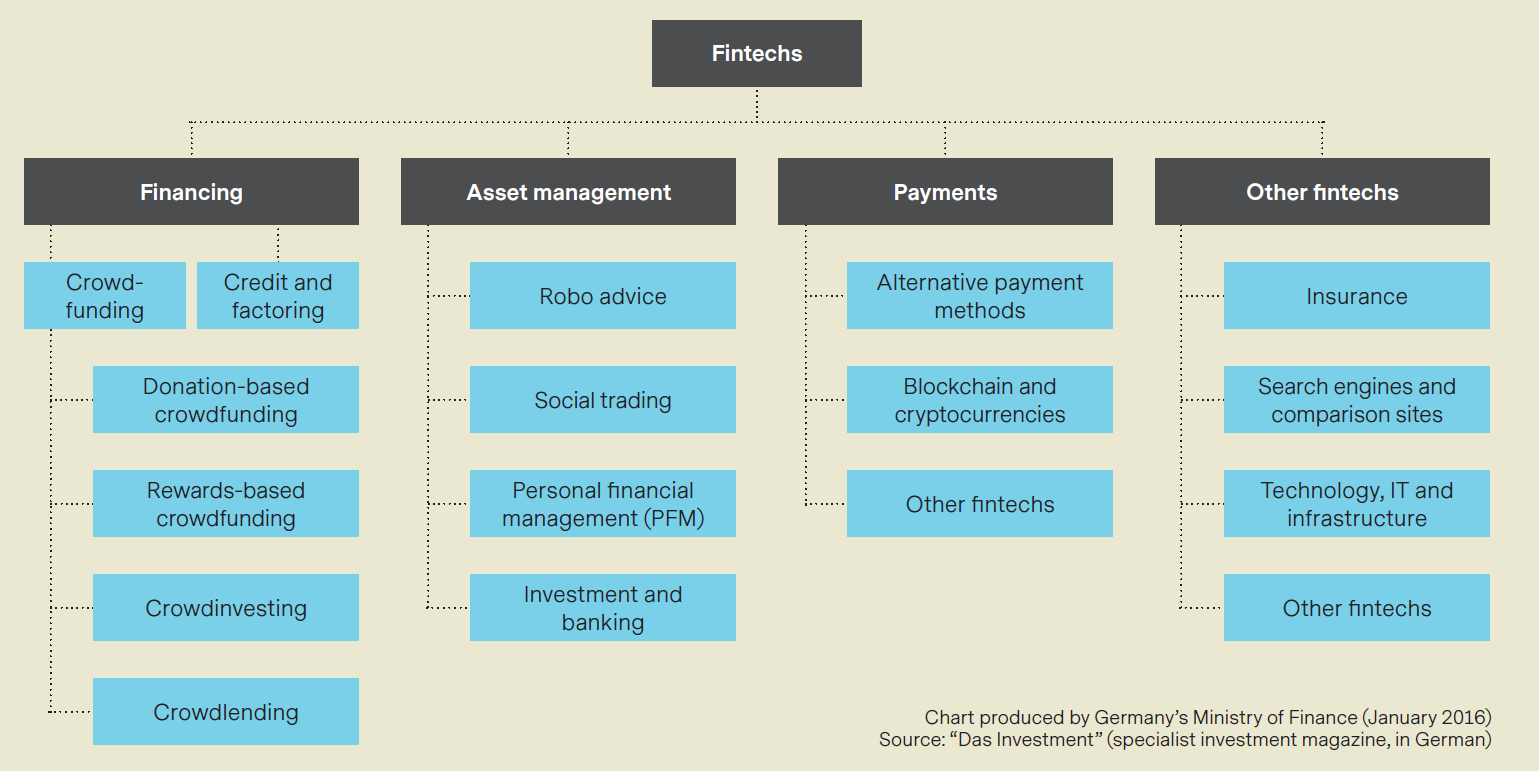

The explosive growth of fintechs has long since aroused the interest of state institutions. Facebook’s Libra, for example, has already attracted the attention of supervisory authorities. The German Federal Ministry of Finance has also taken a close look at the industry, partly for regulatory purposes. It groups fintech companies into four segments: financing, asset management, payment transactions and other fintechs, which is in turn divided into up to six sub segments (see chart below).

Source

1Fintechnews Switzerland, “A Snapshot of Europe’s Fintech Unicorns”, 5 February 2019, http://fintechnews.ch/fintech/a-snapshot-of-the-europes-fintech-unicorns/25253/

2Article in German newspaper Die Welt, “Die Euphorie am Online-Banking ist den Deutschen vergangen”, 16 January 2018, https://www.welt.de/finanzen/article172512081/Girokonto-Deutsche-sind-beim-Online-Banking-skeptisch.html

3Article in Swiss newspaper Neue Zürcher Zeitung “Banken provozieren den Fintech-Umbruch”, 22 August 2019, https://www.nzz.ch/meinung/fintechs-nuetzen-die-schwaechen-der-traditionellen-banken-aus-ld.1501506

4Also known as API banking (from application programming interface)

5Deloitte Research 2019

6Article in Swiss newspaper Neue Zürcher Zeitung “Online-Banken haben ihre Tücken”, 23 August 2019, https://www.nzz.ch/finanzen/cyberangriffe-online-banken-unter-druck-ld.1503480

Publié le 19.11.2019 HNEC