AEI

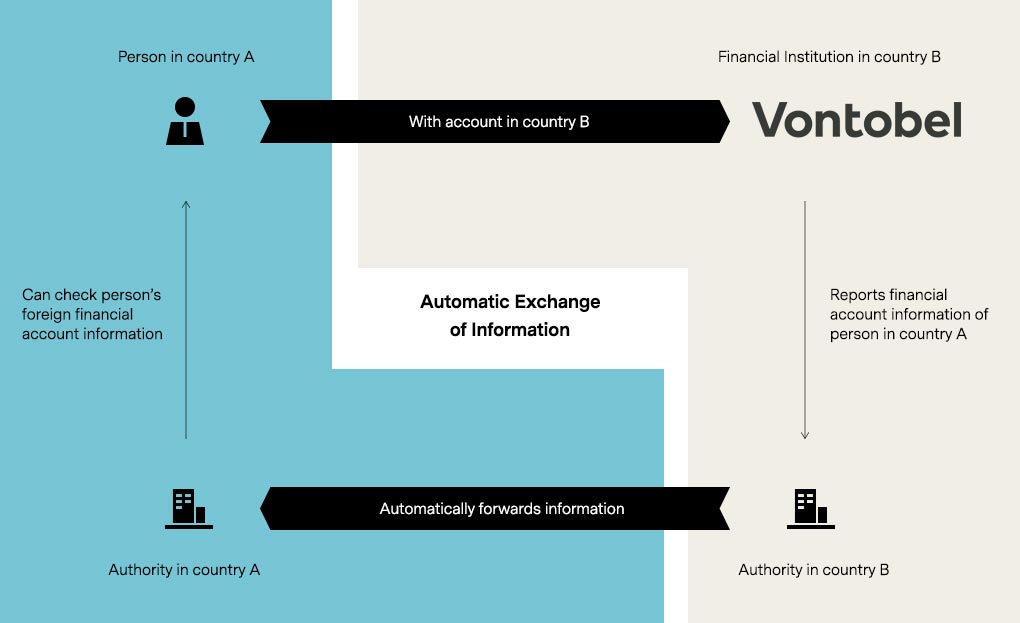

The Automatic Exchange of Information (AEI) is an international standard that rules how tax authorities of participating countries exchange information relating to taxpayers’ foreign banking relationships. The AEI standard has been developed and published by the Organization for Economic Cooperation and Development (OECD).

The AEI standard will be implemented by all major economies in the world; approximately 100 countries have already committed to implement the standard. Participating countries will sign bilateral agreements and enact domestic laws. The «Early Adopters», such as the EU, implemented the AEI on 1 January 2016 and will first exchange information in 2017. Further countries, such as Switzerland, will implement the Standard as per 1 January 2017 and first exchange information in 2018. More countries are expected to follow.

The AEI standard requires financial institutions, such as Bank Vontobel, to identify all clients that are tax residents in another participating jurisdiction. This also applies to controlling persons of certain entity clients. Once such a reportable person is identified, Bank Vontobel will annually report the relevant information to the Swiss Federal Tax Administration (FTA), which will forward the data to the tax authority of the jurisdiction in which the reportable person is resident for tax purposes.

Further links:

Participating jurisdiction

Tax identification number (TIN)

Country information regarding tax residence