- Home

- About Vontobel

- Media

- Media releases and news

- Survey of Swiss public shows trust in digital investment offerings is growing

Survey of Swiss public shows trust in digital investment offerings is growing

Published on 25.11.2020 CET

- New representative study reveals strong potential for digital investment products

- Many investors already invest their money digitally or express an interest in digital investing

- Digital investors in Switzerland favor hybrid digital wealth management solutions

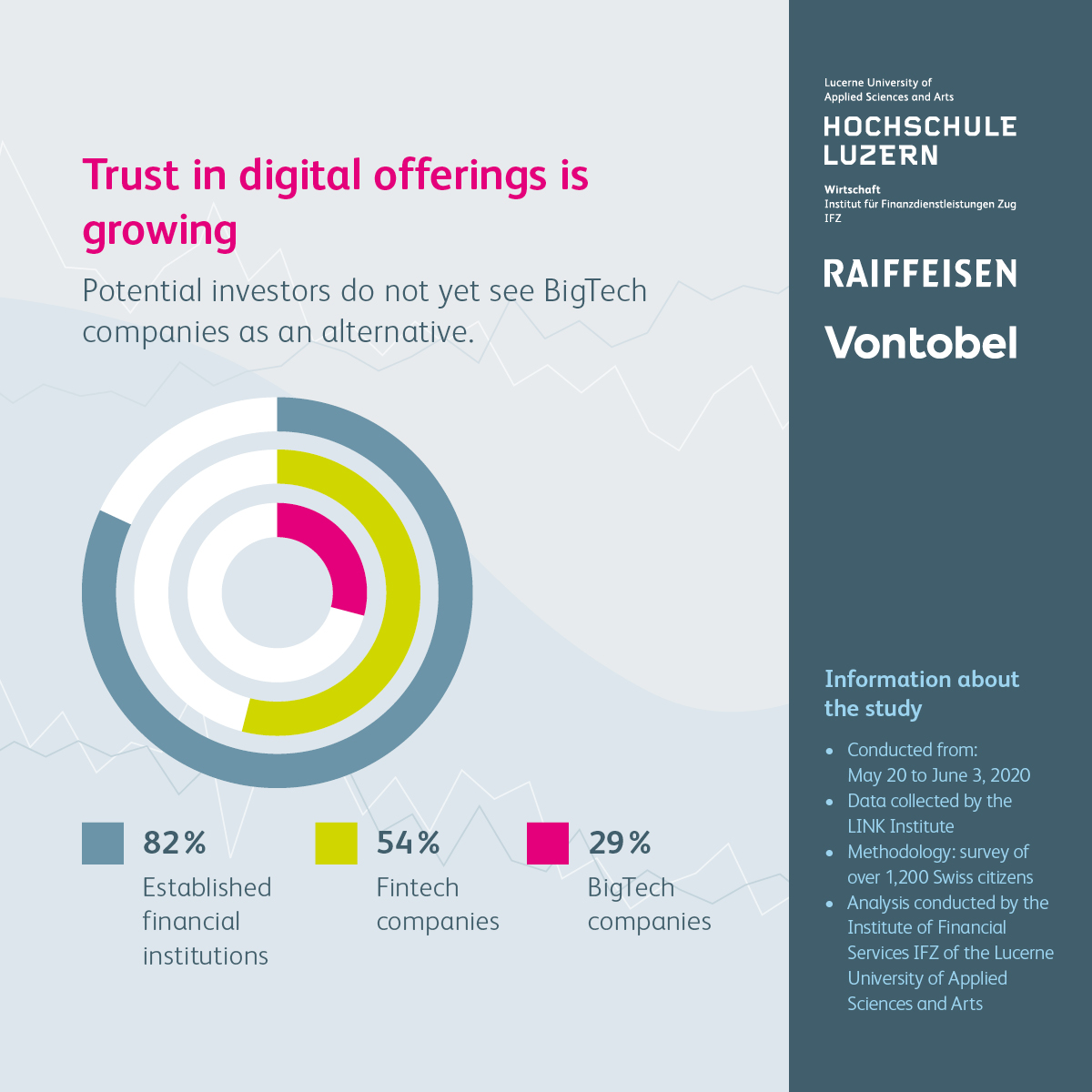

- Established financial services providers have an advantage in terms of trust

- Vontobel expects to see increased demand for digital offerings due to the growing need for investments

The number of fintech firms in Switzerland has almost doubled over the last five years. Around 150 fintechs provide services in the area of investment management. However, potential Swiss users of digital investment opportunities trust the solutions offered by established financial services providers more than those of fintechs. The hybrid model – comprising a digital tool with an established banking provider in the background – has especially strong potential, as the majority of investors don’t wish to give up the support of a personal advisor. These are the findings of the study conducted by the Institute of Financial Services Zug IFZ of the Lucerne University of Applied Sciences and Arts. It was commissioned by Raiffeisen and Vontobel to carry out a survey of more than 1,200 members of the Swiss public aged between 18 and 79 across all regions of Switzerland. The average age of digital investment products users was found to be 50 years, although Swiss respondents aged over 65 are best informed about digital investing. The study also revealed that women are less well informed about these offerings than men. The topic is growing more important due to the low interest rate environment and the increasing need for pension provision. Although many of the survey participants were generally not well versed about wealth management, one quarter of Swiss respondents already invests digitally or could imagine using such products in the future. More than half of all investors was not familiar with specific digital investment products. The Lucerne University of Applied Sciences and Arts believes that this area offers significant potential for the coming years. Digital investment products could become standard offerings at many banks in the next few years.

According to the study ‘Digital Investing in Switzerland – A Market with Potential’ published by the Institute of Financial Services Zug IFZ of the Lucerne University of Applied Sciences and Arts, the greatest potential for digital investment opportunities can be found among members of the Swiss public who reach their own independent investment decisions (‘Soloists’) and among the group of so-called ‘Validators’ who essentially take investment decisions with the support of partners or investment advisors.

|

|

Further infographics are available for download below

At 56%, Validators represent the largest group of investors in Switzerland, and 7% of them already invest their assets digitally, while 12% see themselves as potential users. Validators are found most frequently in German-speaking Switzerland and Ticino. They are often members of the baby boomer generation and are mainly women. Soloists consist primarily of men from German-speaking Switzerland who belong to Generation Z or Generation X. They represent the second-largest group of investors at 34% of survey participants. Every tenth Soloist already uses digital wealth management solutions, and every fourth Soloist could imagine investing money digitally in the future. The smallest group of investors, accounting for 10% of respondents, are ‘Delegators’. In general, they fully delegate their investment decisions to their advisor. Among Delegators, 6% already invest digitally at present, and 11% state that they could imagine doing so in the future. Women, members of Generation Y (born between the early 1980s and the late 1990s) and people from French-speaking Switzerland are overrepresented in this group of investors.

Transparency and user friendliness are the priority

The fact that digitalization is not a question of age is demonstrated by the finding that respondents aged over 65, as well as people from German-speaking Switzerland, men and also people with more than CHF 100,000 of assets feel they are best informed about digital investment solutions. Members of the Swiss public mainly expect a digital wealth management solution to offer transparency (54%). Validators are seeking transparency (57%), user friendliness (39%) and simplicity (48%). The study also shows that clients are prepared to pay an appropriate price for a good offering. Validators and Delegators in particular assign less importance to costs than to transparency and user friendliness. Compared to Soloists, these client groups also assign a disproportionately high level of importance to a broad digital product range and to the option to personalize the portfolio. Soloists, for whom these aspects are less important, are most focused on pricing (63%).

Growth potential for hybrid models

The demand for individual options is reflected in the increasing range of investment solutions offering both a high level of personalization and also a high level of sophistication. Clients are, among other things, assigning ever greater importance to effective processes to determine the risk profile and to a larger selection of asset classes. Since established providers cover precisely these requirements, their digital hybrid solutions should be able to profit from this trend.

Accumulation and preservation of wealth, as well as pensions, are primary goals

Across all regions, genders, age groups and categories of wealth, the respondents are pursuing the same investment objectives. The accumulation of wealth (52%), saving for old age (46%) and wealth preservation (36%) feature at the very top of the agenda for the typical Swiss man and woman. They regard investing as a serious matter, with only around 10% stating that they associate investing with fun or speculation.

Around two-thirds of the survey participants invest for a minimum term of five years. Investment horizons are above average in the case of respondents from German-speaking Switzerland, Delegators and members of Generation X. In contrast, the goals pursued by Soloists as well as members of Generation Z (born in or after 1997) are much less long term. Nevertheless, Soloists in particular can imagine also making use of digital offerings to build their Pillar 3 pension savings in the next 12 months. Overall, 22% are also considering digital investments for their Pillar 3a in the next 12 months. It is primarily men, investors with above-average earnings and younger people who are also interested in digital solutions for their pensions.

The study confirms that despite this period of negative interest rates, the average Swiss man and woman envisages using investment savings plans for their pensions. The opportunities offered by the capital market are used primarily by Soloists as well as Validators and members of Generation X. Every fourth person who holds a Pillar 3a account does not know whether – and if so, which proportion – of those pension assets are invested in securities.

Although the study shows that digital wealth management solutions have potential, it also indicates that digital investment solutions are not well known – also when comparing Switzerland with other countries. Only 13% of all survey participants (and 18% of investors) said that they possessed slight to good knowledge of these products.

Rising demand expected

The Institute of Financial Services Zug IFZ of the Lucerne University of Applied Sciences and Arts believes that the demand for digital wealth management solutions will increase in the coming years – driven by the growing range of offerings as well as by the entry into this segment of major market participants with large client bases.

“The study confirms the merits of our strategy of harnessing the power of modern technology to deliver the best possible advice and client service. Digital wealth management solutions such as Vontobel Volt® complement existing services. Further, they provide opportunities to address new wealthy clients who also want to invest themselves and assign a high level of importance to the extensive investment expertise offered by an established investment firm. They also want to have access to a broad digital product offering as well as options for portfolio customization,” stated Toby Triebel, Head Digital Investing at Vontobel.

Vontobel, which launched the digital wealth management solution Volt® in fall 2019, believes that the demand for investment opportunities will continue to grow in the coming years and will thus lend further momentum to digital solutions. “In view of the continuation of low interest rates and the significant need for pensions that is driven by the demonstrably large pension gap alone, investing is becoming the new form of saving for clients who want to generate returns on their capital,” commented Toby Triebel.

“Overall, we expect that these products will increasingly establish themselves as standard offerings at many banks and that volumes will increase accordingly. At the same time, however, such solutions will remain niche products in Switzerland over the next five years in terms of the total investment volume,” stated Dr. Andreas Dietrich, Head of the Institute of Financial Services Zug IFZ of the Lucerne University of Applied Sciences and Arts.

Study Digital Investing

202011_Studie-Digitales-Anlegen_ENG.pdf

Presentation Digital Investing

202011_DigitalesAnlegen_Praesentation-Storyline_EN.pdf

Infographic

Infografics_Investment_Goals_EN_1.pdf

Infografics_Level_of_Expertise.pdf

Infografics_Types_of_Investors_EN_4.pdf

Media Relations

peter.dietlmaier@vontobel.com

+41 58 283 59 30

urs.fehr@vontobel.com

+41 58 283 57 90

Investor Relations

peter.skoog@vontobel.com

+41 58 283 64 38

francesco.sigillo@vontobel.com

+41 58 283 75 52

Vontobel

At Vontobel, we actively shape the future. We create and pursue opportunities with determination. We master what we do – and we only do what we master. This is how we get our clients ahead. As a globally active investment manager with Swiss roots, we specialize in wealth management, active asset management and investment solutions. We harness the power of technology to deliver a high-quality, individual client experience and to deploy our investment expertise across multiple platforms and ecosystems. We empower our employees to take ownership of their work and bring opportunities to life. We do so based on the conviction that successful investing begins with the assumption of personal responsibility. We continuously scrutinize our achievements as we strive to exceed the expectations of our clients. The registered shares of the Vontobel Holding AG are listed on the SIX Swiss Exchange. The Vontobel families' close ties to the company guarantee our entrepreneurial independence. We consider the resulting freedom as an obligation to also assume our social responsibility. As of September 30, 2020, Vontobel held CHF 294.1 billion of total client assets. Around the world and in our home market, we serve our clients from 26 locations.

Legal information

This document is provided purely for informational purposes and is expressly not directed at persons whose nationality or place of residence prohibits access to such information on account of existing legislation. The information and views contained in it do not constitute a request, offer, or recommendation to use a service, to buy or sell investment instruments, or to conduct other transactions. Forward-looking statements, by their nature, involve general and specific risks and uncertainties. It should be noted that there is a risk that forecasts, predictions, projections, and results described or implied in forward-looking statements may not prove to be correct.

Published on 25.11.2020 CET