- Home

- About Vontobel

- Media

- Media releases and news

- In 2016, Vontobel became the first provider to offer Swiss and German investors tracker certificates on bitcoin, thus making the latter a ‘bankable asset’. In light of the strong demand, it is now increasing the investment volume from the original CH

Vontobel is now increasing the investment volume in light of the strong demand

Published on 08.09.2017 CEST

Vontobel offers investors in Switzerland and Germany the exclusive possibility of participating in the bitcoin price trend via a listed tracker certificate, i.e. within the established banking system. A tracker certificate has been traded on the SIX Swiss Exchange since mid-2016. Owing to the considerable demand, the issue size was increased to 15,000 as of 15 March 2017, corresponding to an investment volume of around CHF 18 million. As at 3 April 2017, this tracker certificate’s performance stood at +75%.

In offering this investment opportunity in bitcoin, Vontobel is expanding further into the digital world, bringing investment expertise and fintech ever closer together. “Vontobel is thus once again demonstrating its capacity for innovation as one of the leading providers of structured products,” said Roger Studer, Head of Vontobel Investment Banking. “With our bitcoin certificates, we are giving investors the exclusive possibility of investing in this digital currency on the Swiss and German exchanges, investments they can then book to their custody accounts.”

Investment volume increased due to high demand

With Vontobel, investors in Switzerland, Germany and Austria can invest in bitcoin and so participate in the development of the bitcoin price trend in USD and EUR. In July 2016, Vontobel became the first and only provider to launch a tracker certificate on bitcoin, with an initial investment volume of around CHF 1.7 million in Switzerland and EUR 6 million. In light of the strong demand, the number of certificates was increased as of 15 March 2017 to 15,000 in Switzerland, and in Germany from 55,000 originally to 70,000. This corresponds to an investment volume of around CHF 18 million and EUR 7.8 million respectively.

These exceptionally successful tracker certificates, which as of 3 April 2017 boasted a performance since launch of 75% in Switzerland and 59% in Germany, can be traded at the current bid/ask prices on the Swiss Exchange and on the exchanges in Frankfurt and Stuttgart respectively. The final fixing will be on 16 July 2018.

Bitcoin: increasingly accepted, increasing in value

Bitcoin is a purely electronic peer-to-peer cash system that allows for online payments between two parties without the involvement of an intermediary. Bitcoin, which is exclusively used digitally, is increasingly being accepted as a means of payment. It is also increasing in value, with the price of one bitcoin recently surpassing that of one ounce of gold for the first time ever.

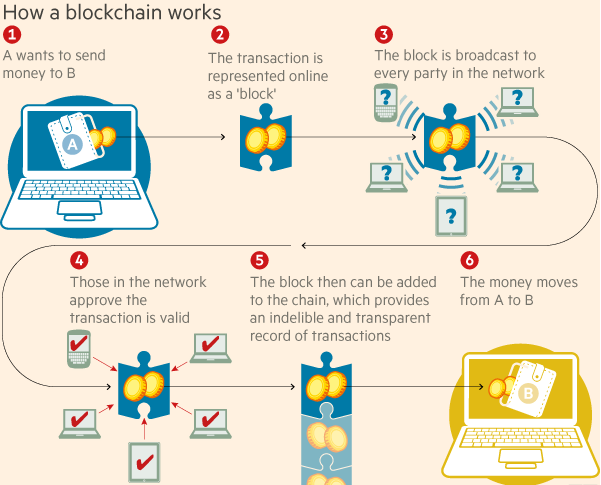

Chart 1. How a blockchain works (source: Financial Times, online, 27.06.2016) For illustrative purposes only.

No personal bitcoin ownership required

With Vontobel’s tracker certificates, investors participate in the bitcoin price trend, without themselves having to have access to a bitcoin platform. The investors therefore do not bear the risk of a loss of bitcoins as a result of hacker attacks, technical problems, improper handling, or the failure of a bitcoin custodian. Vontobel’s certificate therefore makes a bitcoin investment a bankable asset, one that can be integrated directly in a portfolio allocation or custody account. The certificate on bitcoin is also suitable as a means of adding diversification to traditional portfolios.

Vontobel Investment Banking

Vontobel Investment Banking provides customized investment solutions for clients and external asset managers. It is one of the leading issuers of structured products in Switzerland and Europe and has a presence in Asia. Its award-winning research and its expertise in corporate finance, as well as the securities services provided by Transaction Banking, complete its offering. Investment Banking is also a global leader in the digitalization of investment solutions. www.vontobel.com/ib

Vontobel Investment Banking is one of Vontobel’s three divisions – together with Private Banking and Asset Management – whose mission is to protect and build the wealth clients have entrusted to them over the long term. In doing so, Vontobel is committed to Swiss quality and performance standards. With their good name, the owner families have stood by these principles for generations. The registered shares of Vontobel Holding AG are listed on the SIX Swiss Exchange. The Vontobel families and the Vontobel Foundation hold the majority of shares and votes in the company.

Legal information This press release is intended solely for information purposes. The information and views contained in it do not constitute a request, offer or recommendation to use a service, to buy or sell investment instruments or to conduct other transactions. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that predictions, forecasts, projections and other outcomes described or implied in forward-looking statements will not be achieved.

Published on 08.09.2017 CEST