5 investment myths debunked

Published on 21.05.2022 CEST

Myth 1: Cash is safe

Myth 1: Cash is safe

In fact, hoarding cash leads to devaluation by inflation. Your money buys a lot less.

Source: Vontobel 2022.

Discover why the old “safe” has become the new “false friend”

Before investing in stocks, bonds or any other asset class, people often hesitate for one simple reason: “I might lose money!”

Yes, that’s true. Investing money can result in losing money.

But the very same is happening today—day to day—if you’re hoarding cash to protect your assets. Even though the balance on your account statement doesn’t change, the value you get for your assets may be steadily decreasing.

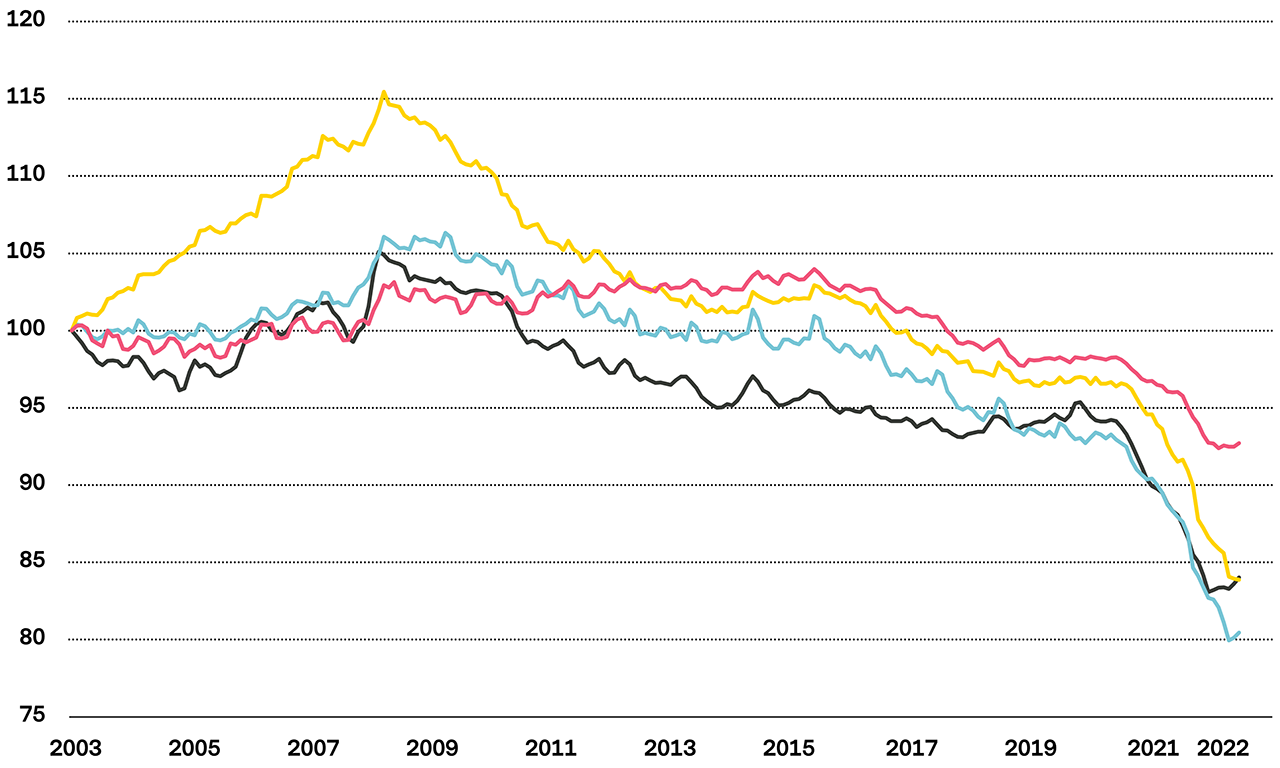

During a period of monetary easing, the purchasing power of cash plummeted.

Safe haven 1: Devaluation of cash in local currency vs. local inflation

▬ USA ▬ Eurozone ▬ United Kingdom ▬ Switzerland

Source: Bloomberg; cash less month-over-month inflation (CPI all items).

Past performance is not a reliable indicator of current or future performance.

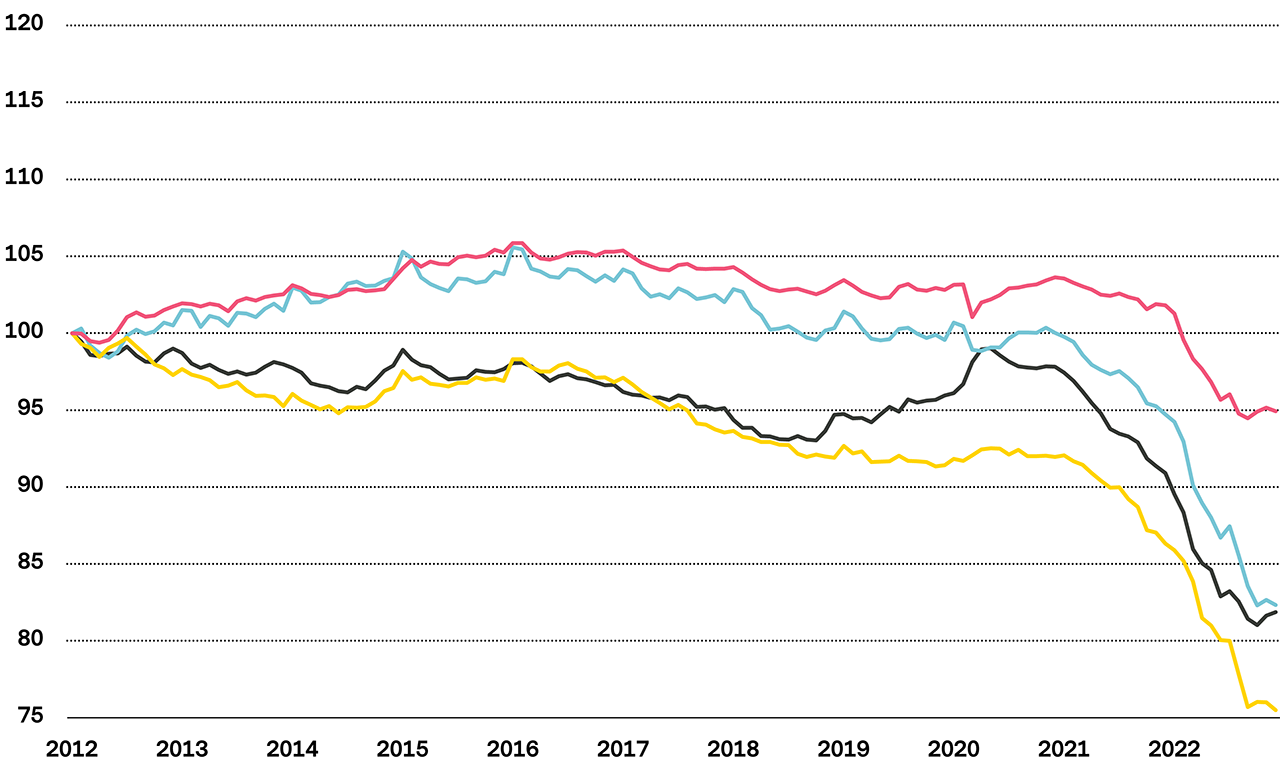

Similar to cash, the former “safe haven” of sovereign bonds has lost purchasing power over the last decade.

Safe haven 2: Devaluation of short-term sovereign bonds in local currency vs. local inflation

▬ USA ▬ Eurozone ▬ United Kingdom ▬ Switzerland

Source: Bloomberg; 1–3 years sovereign bonds, less month-over-month inflation (CPI all items).

Past performance is not a reliable indicator of current or future performance.

Myth 2: You need to wait for the right moment to enter

Actually, compound interest effects can tip the balance of your investmentSource: Vontobel 2022; for illustrative purposes only.

Four ways of investing 100 USD over twenty years: Investors who enter the market at once unlock better long-term compound effects compared to investors who stagger the same amount over time. Illustration based on an estimated 10% returns per annum.

Discover why immediate investment often pays off

Most investors have a clear vision when it comes to entering the market or re-investing their liquid positions: Waiting until markets are at a favorable low.

But what does a favorable “low” mean in practice? The lowest price in an intra-day perspective? The bottom after a market sell-off in a region? A global crisis or a crash?

In fact, entering the market in a cautiously staggered manner can affect your performance more than possibly “bad” timing in the beginning, e.g., entering the market at peak time.

“Historically, the immediate investment paid off most”.

Entering the market in a cautiously staggered manner can affect your performance more than possibly “bad” timing in the beginning, e.g., entering the market at peak time. Slide right to learn more:

Source: Vontobel 2022. S&P 500 Index returns from 01.02.1990 to 31.01.2023, daily total returns (including dividends), gross.

Note: Past performance is not a reliable indicator of current or future performance.

Source: Vontobel 2022. S&P 500 Index returns from 01.02.1990 to 31.01.2023, daily total returns (including dividends), gross.

Note: Past performance is not a reliable indicator of current or future performance.

Myth 3: Timing the market is the only source of returns

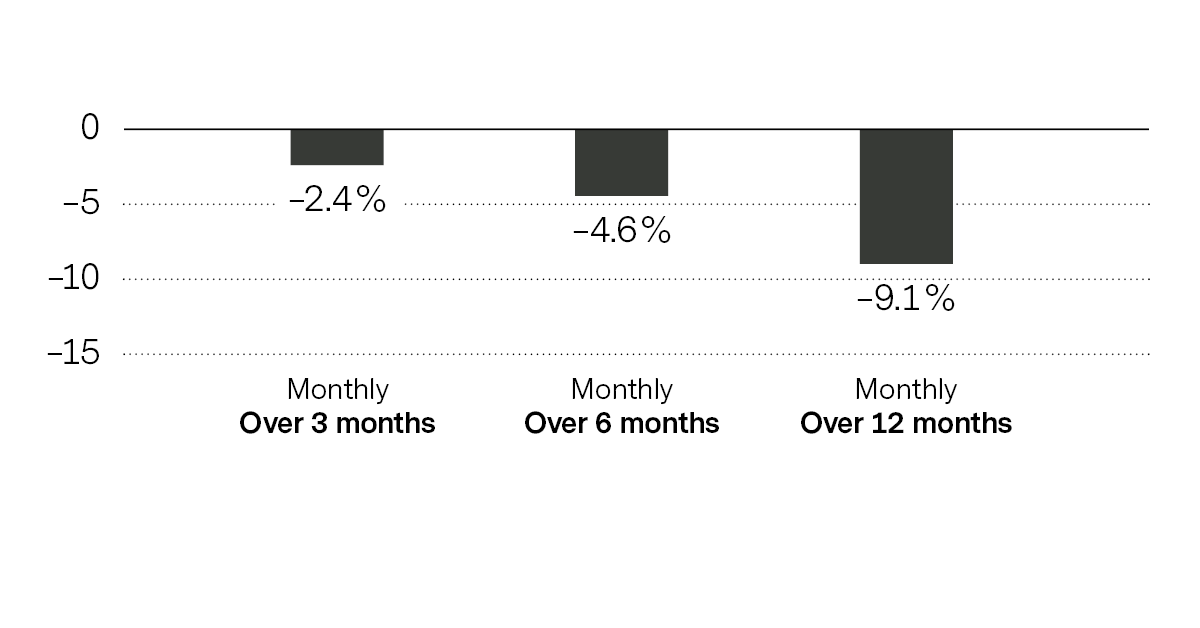

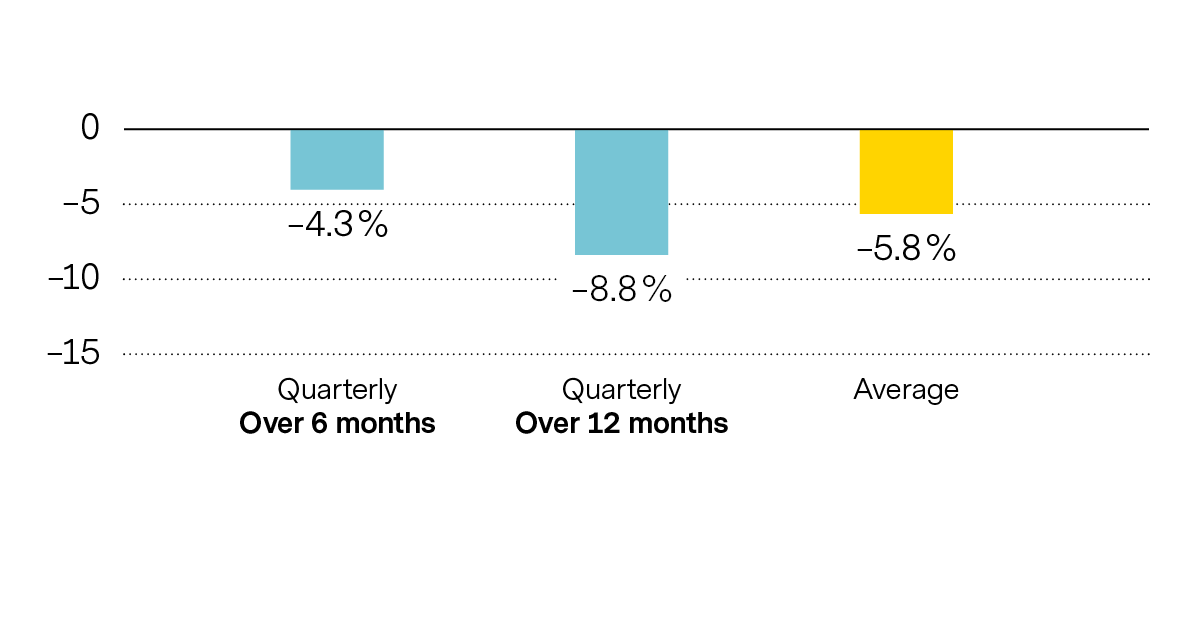

What does history teach investors?

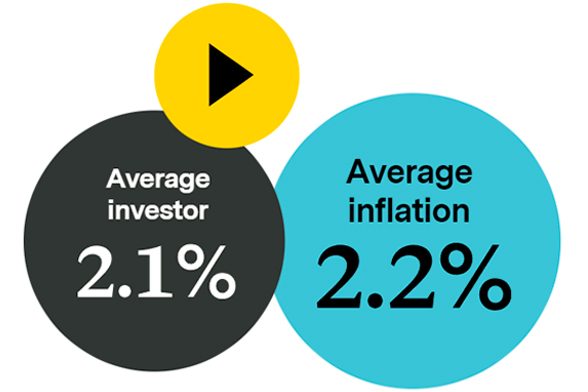

The average investor does not retain real wealth.

Source: Inflation based on US Consumer Price Index (CPI); average investor represented by Dalbar’s average asset allocation investor return, which utilizes the net of average mutual fund sales, redemptions and exchanges each month (“Investing & Emotions”, BlackRock Investment Insight 2016).

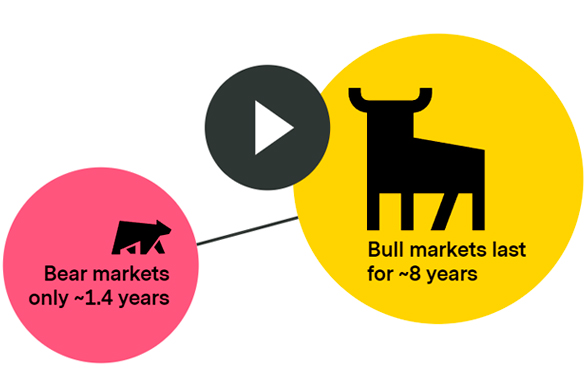

Don’t be afraid—bulls have endurance, bears don’t

Source: Vontobel 2022.

In the bear market, it’s the perspective that matters

Despite investor’s natural bias to vividly remember bear days, only a small number of trading periods were actually bearish in the past. Chart compares the number of bear market days versus the number of bull market days per occurrence, summed up as average of years.

Time in the market is the long-term investor’s business

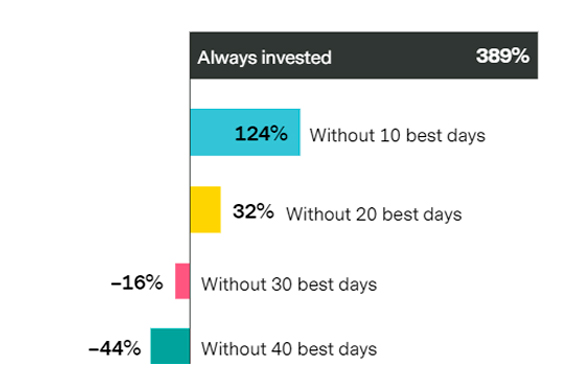

A look at the total returns in global equities between 1999 and 2022, demonstrates where the “fear of missing out” (FOMO) comes from—and that staying invested can be your antidote.

Source: Bloomberg, based on the index MSCI ACWI from 01.01.1999 to 31.12.2022, daily total returns (including dividends), gross.

Note: Past performance is not a reliable indicator of current or future performance.

Discover why a longer time horizon lowers investment risk

Buy when valuation is low—sell when shares are at their peak. For generations, this campfire story has hardly changed.

Unfortunately, a peak is hardly visible when you’re on it but comes into view only after the descent has begun. The same is true at a potential bottom when trying to time the first days of a rebound. As hard as they can be to time, those days are the few days that make all the difference.

How to unlock this potential and, at the same time, make sure not to miss out on the best days?

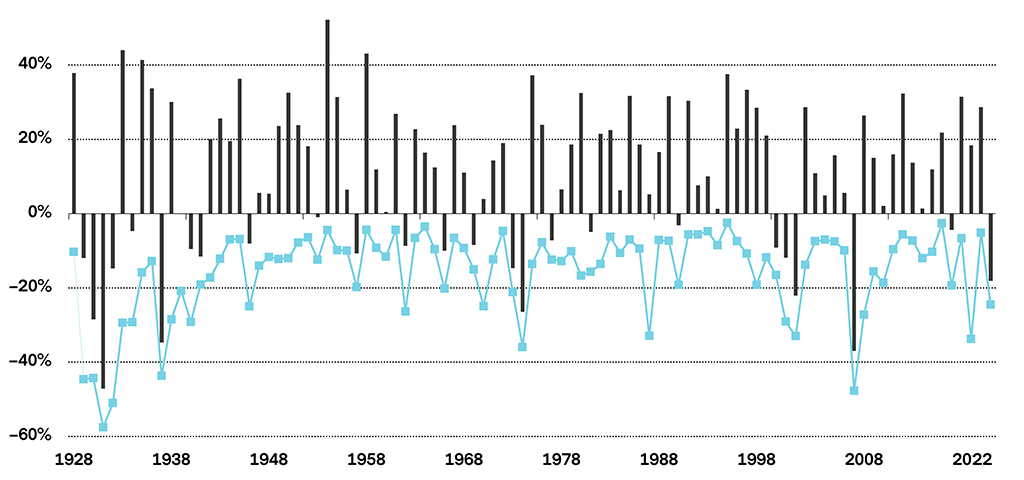

When looking at maximum intra-year drawdowns since the infamous 1928 crash, we learn that drawdowns are usually recovered, at least partially, by the end of the year.

Why it’s not worth being overly afraid of drawdowns in detail:

▬ S&P 500 returns ▬ Intra-year drawdown

Source: S&P 500 historical returns from 1928 to December 31, 2022, daily total returns (including dividends), gross.

Note: Past performance is not a reliable indicator of current or future performance.

Myth 4: Portfolio diversification is good for safety, not for returns

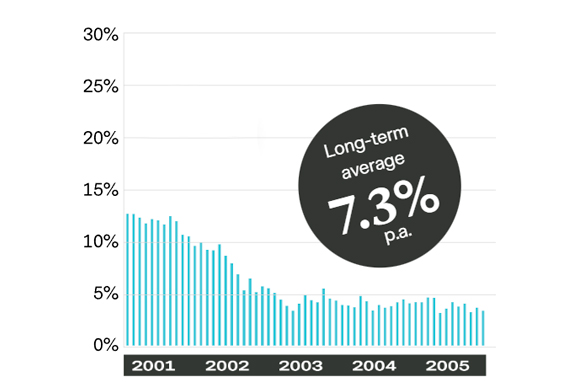

Performance of a balanced portfolio since 1900

A balanced portfolio is positive in 97% of cases in any 5-year period over 122 years.

Looking at the big picture:

Source: Vontobel 2022, Bloomberg, Global Financial Data; income from the S&P 500 Index and US Government Bonds from 1900 to end of 2022, annual total returns (including dividends), gross. Note: Historical data doesn’t guarantee the same course of events in the future. Not applicable to all regions and/or investment styles.

A balanced portfolio can be exemplified by 45% equities and 55% government bonds. A holding period of five years and more is the kind of long-term perspective investors favor.

Now let’s do the math: 97% of the time, a balanced portfolio spanning five years or more in any given timeframe ends up in positive territory and yielded, in fact, +7,3% per annum over the last 122 years.

Discover why a long-term balanced investment strategy is a solid foundation

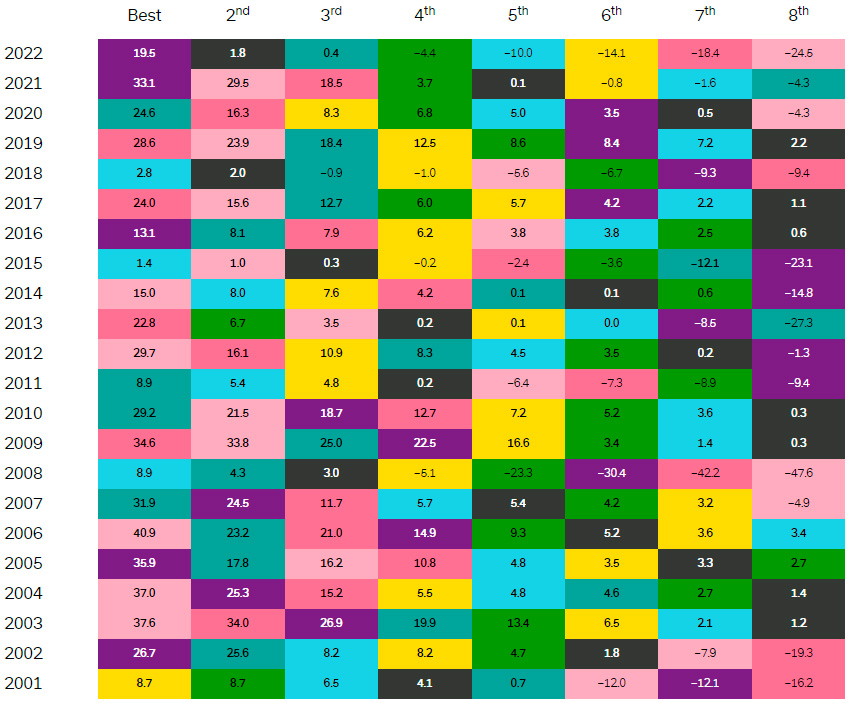

To the ears of speculative investors, diversification sounds rather defensive, but professionals know: Diversification can be a free lunch and may unlock alpha sources of return.

How?

A balanced portfolio combines returns of equities and the stability of bonds with higher returns.

“Investors often need to take risks to achieve their investment goals, but individual asset classes do not perform every year”.

Annual returns of key asset classes (in %, USD)

▬ Commodities ▬ Cash ▬ Gold ▬ Hedge funds ▬ Global sovereigns ▬ Corporate bonds ▬ Global equities ▬ Global real estate

Source: Vontobel 2022. Indexes used to track asset classes: Cash (USD) SBWMUD1U, Global Sovereigns (USD) LGAGTRUH, Global Corporate Bonds Investment Grade (USD) LGCPTRUH, Equities AC (USD) NDUEACWF, Gold (USD) GOLDLNPM, Commodities (USD) BCOMF3T, Global Real Estate (USD) MXWO0RE, Hedge Funds (USD) HFRXGL.

Note: Past performance is not a reliable indicator of current or future performance. Performance data does not take into account any commissions and costs charged when shares of the fund are issued and redeemed, if applicable. The return of the fund may go down as well as up due to changes in rates of exchange between currencies.

Myth 5: Passive is always the best way to go

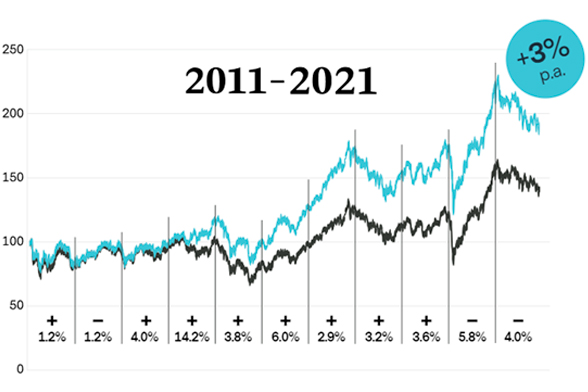

Net returns of an actively managed fund vs. an index

Source: Bloomberg, net returns of the Vontobel Fund mtx Sustainable Emerging Markets Leaders A (VGREMEI LX Equity) versus the MSCI Emerging Markets index (MXEF) from 16.07.2011, when the fund was launched, to 31.12.2021.

Note: Not all actively managed funds succeed in beating a comparable, index-based passive product. According to Morningstar’s European Active/Passive Barometer 2021, active funds’ success rates over the ten years through June 2021, were less than 25% in nearly two-thirds of the categories surveyed. Past performance is not a reliable indicator of current or future performance. Performance data does not take into account any commissions and costs charged when shares of the fund are issued and redeemed, if applicable. The return of the fund may go down as well as up due to changes in rates of exchange between currencies

Legal note

Investment Suitability: This publication is intended for general distribution. It is not part of any offer or recommendation and does not take into account your knowledge, experience and personal situation which is required for personal investment advice.

This publication is deemed to be marketing material within the meaning of Article 68 of the Swiss Financial Services Act and is provided for informational purposes only. We will be happy to provide you with additional information about the specified financial products, such as the prospectus or the basic information sheet, free of charge, at any time.

This publication should not be construed as a solicitation or offer, or recommendation to acquire or dispose of any investment or to engage in any other transaction. The services described in this publication are supplied exclusively under the agreement signed with the service recipient. The facts presented and views expressed herein are for information purposes only and do not take account of any individual investment targets, financial circumstances or requirements. Moreover, the nature, scope and prices of services and products may vary from one investor to another and/or due to legal restrictions and are subject to change without notice. Before making an investment decision, investors are advised to consult a professional advisor regarding their individual situation. Prospective investors should be aware that past performance is not necessarily indicative of future results. In no event will we be liable for any loss or damage of any kind arising out of the use of the information contained herein.

Details on how we handle your data can be found in our current data protection policy. If you do not wish to receive any further documents from us, please contact us at wealthmanagement@vontobel.com.

Published on 21.05.2022 CEST