Invest in “Smart Farming” via app

Vontobel Volt® lets you customize your portfolio with up to 14 investment themes – risk-monitored and managed by experts.

Published on 29.04.2018 CEST

A combination of smart farming and the use of food technology is required to boost the agricultural output in order to meet the ever-increasing global demand for food.

This megatrend was first described in May 2018. As its impact on investors has gained relevance, the information and graphics were comprehensively updated and revised in December 2020.

The world population will increase to 9.7 billion people by 2050, according to estimates from the United Nations (UN), with global food production expected to grow by 70% to meet the additional demand that results.

The agriculture sector at the same time faces major constraints, such as the limited availability of arable land, the rising demand for fresh water and a slowdown in the growth of crop yields. The consequences of climate change, including more extreme weather conditions, are other challenges that farmers must deal with.

Use of intelligent farming methods and food technology is part of the solution.

The ongoing digitalization of agriculture has led to the adoption of more sophisticated techniques for growing crops and breeding animals. The increased consumption of non-meat-based protein, new eating trends, particularly in Asia, and the increased awareness of individual dietary requirements have all stirred up a great deal of food innovation.

Of particular interest are:

To understand the actual impact each of the five pillars, it is necessary to understand their different objectives.

Digital agriculture aims to optimize farming yield by using large volumes of information (big data) and technology (GPS services, sensors and robotics).

By using precise planting, fertilization and irrigation methods, farmers can increase their yields by producing more food on the same acreage of land. Modern tractors also gather large amounts of data that can be analyzed and then processed in order to improve yields.

Scientific studies clearly show how crops, plants and farm animals are influenced by environmental factors. These studies aim at finding solutions when producing crops and plants, and breed farm animals with better feed efficiency, disease-resistance, climate-change tolerance and with a higher nutritional quality for human consumption.

The process often starts by the analysis and characterization of the genetics of a crop, plant or animal, and its specific strengths and weaknesses. The crop, plant or animal is then bred to either preserve its genetic diversity or to improve its genetic quality.

Controlled-environment agriculture (in short: CEA resp. SMART-CEA) is an approach where crops are grown indoor with an optimized use of water and space compared to conventional agriculture, while simultaneously controlling for factors such as light, temperature, humidity, CO2 and nutrient concentration.

Vertical farming is a good example, with a welcomed side effect. It enables food production in cities – or at least closer to cities.

Animal health, especially in farms, focuses on solutions that prevent diseases, treat sick animals and control the outbreak of diseases. As for human welfare, alternative proteins at hand, such as plant-based proteins, insects and cellular agriculture are climate-friendly sources of protein, while functional food ingredients aim at enhancing the nutritional profile, taste and conservation of food.

When it comes to personalized nutrition, individual data is collected and tailored nutritional recommendations based on a person’s genetic and environmental factors provided.

An estimated 30% of the food produced for human consumption globally is lost or wasted somewhere along the food supply chain, according to the UN’s Food and Agriculture Organization (FAO). The main reasons behind these massive food losses are inefficient food production and supply systems. Meanwhile, huge amounts of foodstuffs are also wasted as food still fit for human consumption, but unaesthetic for the consumer is thrown away.

Food is also spoiled unnecessarily and therefore wasted due to poor stock management. Waste tracking and analytics solutions help to detect at which step and moment in the food supply chain the actual food loss and/or waste happens.

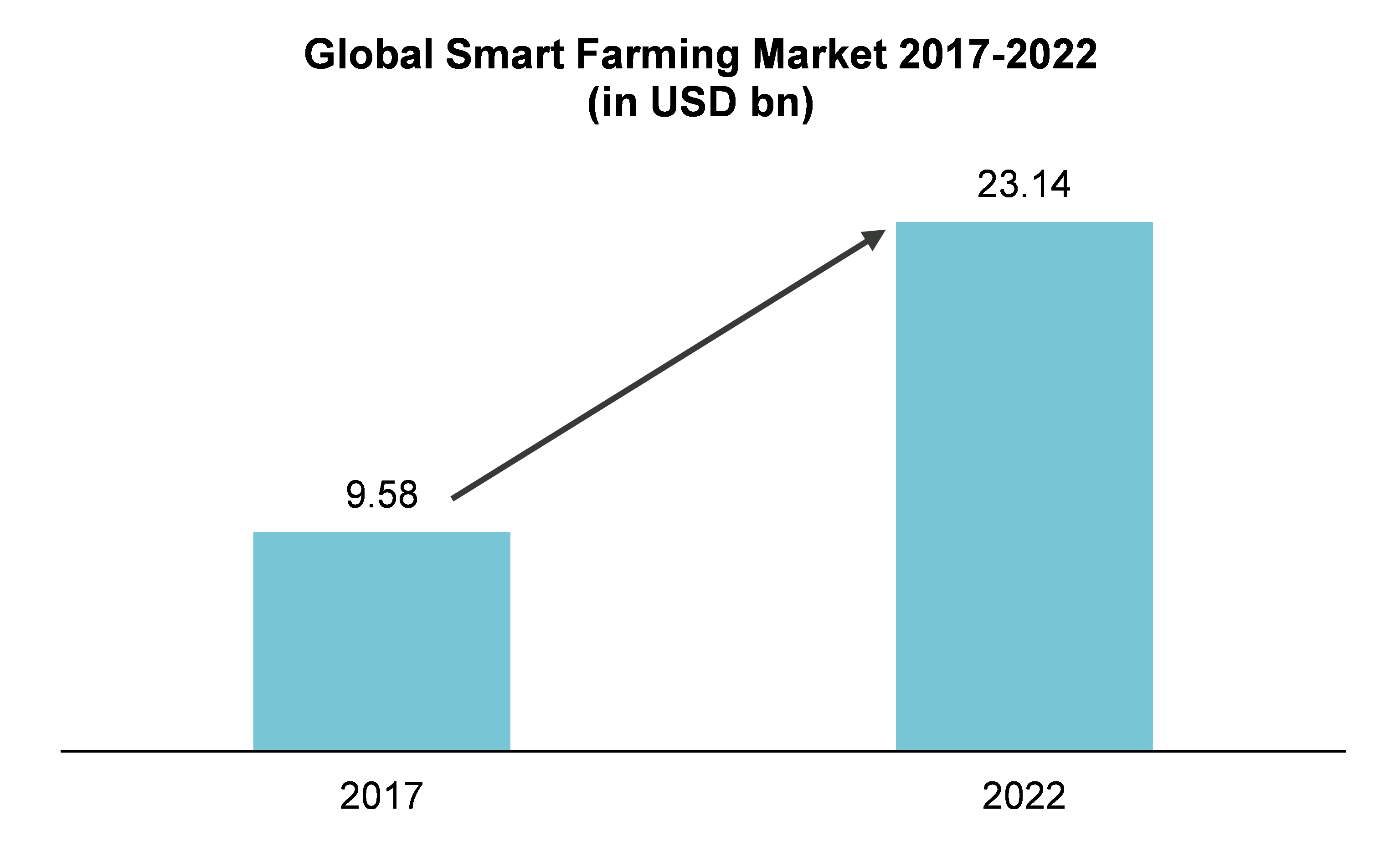

The global market for smart farming will reach just over USD 23 billion in 2022, which corresponds to a compound annual growth rate of 19.3% between 2017 and 2022, according to estimates by the market intelligence company BIS Research.

Selected suppliers of innovative products and services in the smart farming ecosystem should thus benefit from the increasing demand for digitization.

Graph 1: The global smart farming market annually grows by nearly 20% on average

Source: BIS Research (ID 720062), Statista

Compound annual growth rate (CA GR) of 19.3%.

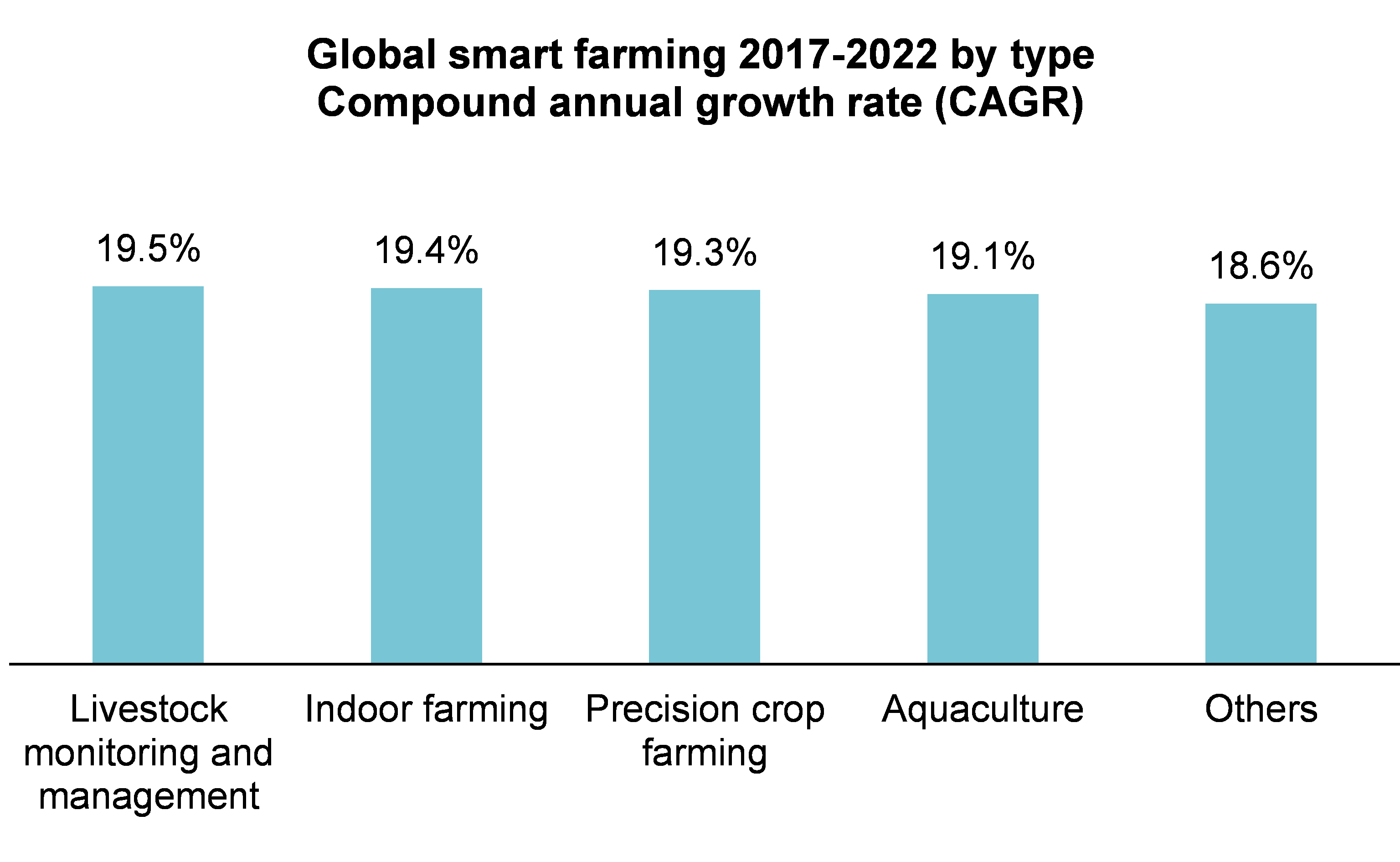

Graph 2: Global smart farming growth between 2017–2022 broken down by segment

Source: BIS Research (ID 957386), Statista

Published on 29.04.2018 CEST