It's time for Europe, it's time for income

Published on 16.05.2025 CEST

Changes in fiscal and defence policies and the cessation of austerity are transforming the investment environment in Europe. Our most recent analysis investigates how these fundamental changes could reveal new prospects for investors looking for income and long-term growth in European stocks.

- Investment Opportunity – we believe European equities are undervalued and often overlooked. Political shifts in the U.S. and Europe could create new opportunities, making the region increasingly attractive for investors. Further, rising volatility and the return of macro cycle favor an income-oriented approach to equity investing, for which Europe is well suited.

- Quality Dividends – The fund seeks to invests in quality dividend stocks which we believe have an attractive, stable/growing dividends. The fund aims to achieve income combined with capital growth.

- Enhanced Income – The fund aims to offer additional income through the sale of call options, where the fund receives cash for the sale of an option and the buyer receives the right to purchase the underlying stock at a predefined price. The buyer may choose not to buy the stock if the predefined price is lower than the market price, or buy the stock if the predefined price is higher.

- Dynamic Participation – A dynamic approach is used to handle extraordinary market conditions. This active management aims to handle sharp downturns and rebounds, offering the potential of additional safeguards compared to a passive strategy.

- Vontobel Fund - Equity Income Plus (EEIP) : a Powerful Strategy – The actively managed fund invests mostly in European equities with the objective to achieve income combined with capital growth, compared to the MSCI EMU. The fund employs option strategies to generate additional income, which provides some cushion during falling markets, in exchange for limited upside participation during rising markets. The fund offers a diversified, income-oriented exposure to European equities, among others.

European Potential

Europe’s investment outlook has improved notably in 2025. Changes in government spending policies, especially in Germany, are driving new investments in defense, infrastructure, and innovative technologies. This shift away from previous austerity measures is likely to encourage more investments in productive assets. With increased market volatility and rising geopolitical tensions, strategies focused on steady income from stocks are becoming increasingly appealing. Dynamic investment strategies, focused on quality stocks that aims to regularly pay dividends and alternative ways of earning income, may provide an attractive way to invest in the stock market.

Vontobel Fund – European Equity Income Plus (EEIP) invests modstly in European equities with an objective to achieve income combined with capital growth, compared to the MSCI EMU. It aims to achieve this by adhering to principles of risk diversification, thus ensuring a balanced portfolio. The fund employs option strategies to generate additional income (which provide some cushion during falling markets) in exchange for limited upside participation during rising markets. The fund offers a diversified, income-oriented exposure to European equities, among others.

Quality Dividend Stocks

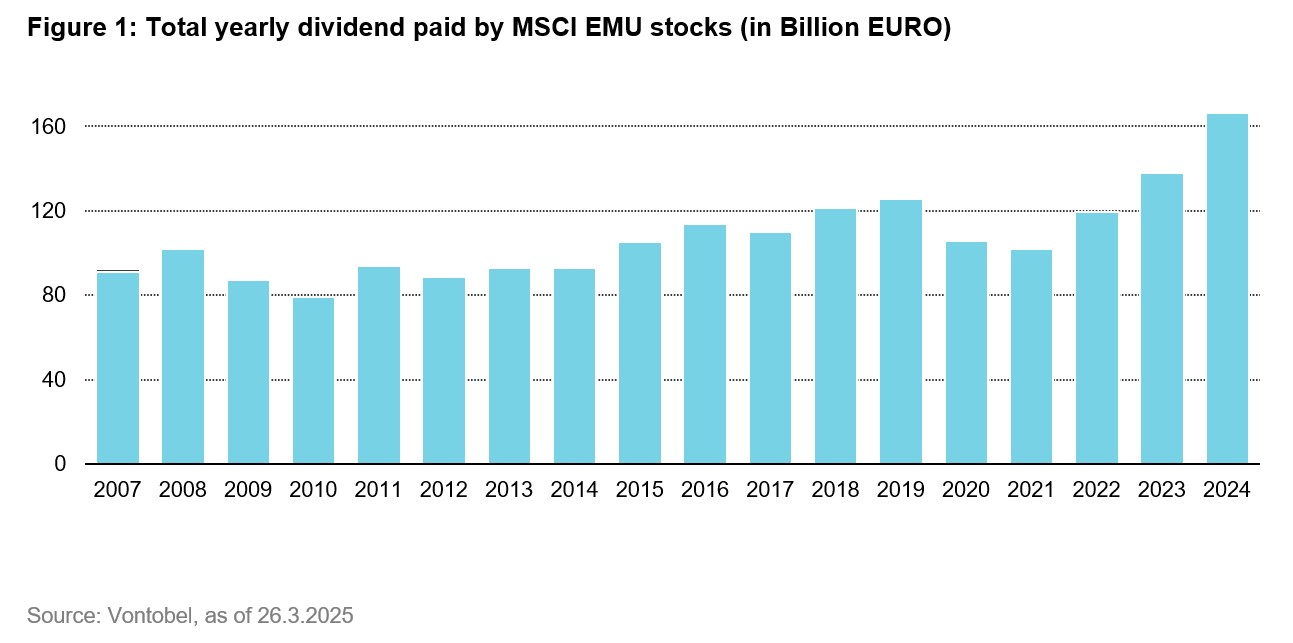

Investing in quality European companies that may regularly pay dividends can provide reliable income. Historically, dividend payments from European companies (tracked by the MSCI EMU index) have been relatively stable and have shown growth in recent years, as shown in Figure 1. Importantly, high-quality companies tend to maintain dividend payments even in tough market conditions, offering investors greater protection against market downturns.

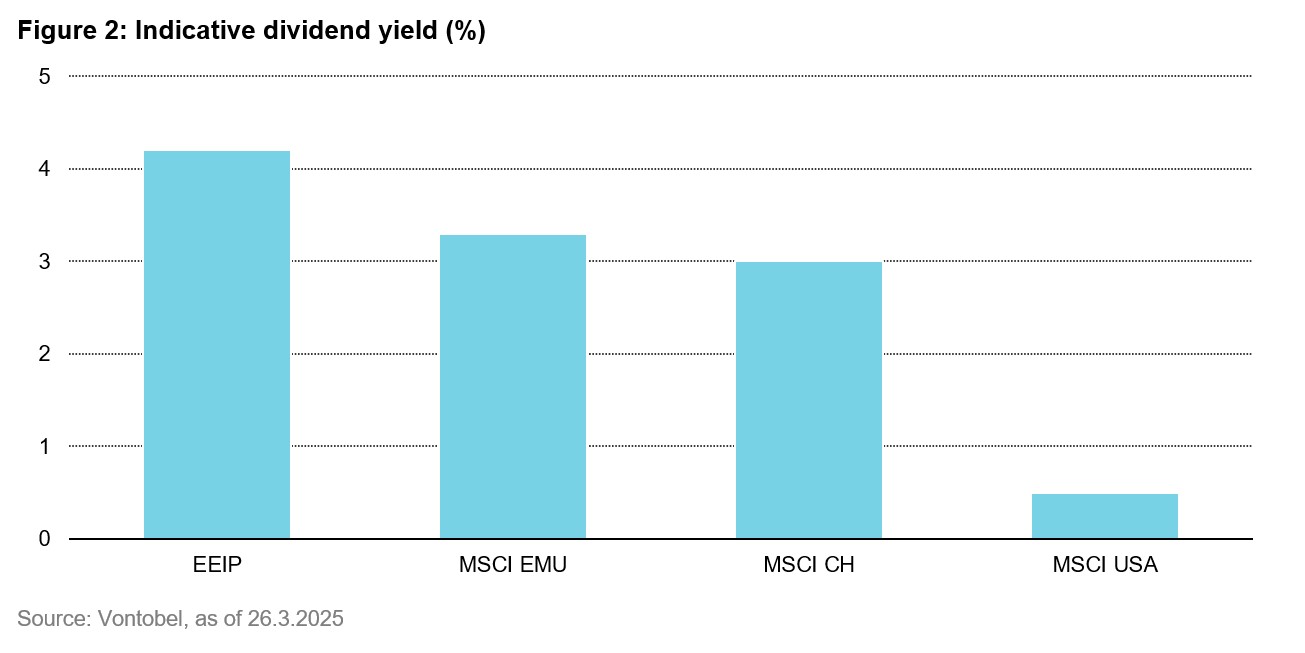

Figure 2 highlights how European companies, represented by the MSCI EMU, typically offer higher dividend payments compared to companies from other regions. The Vontobel Fund - European Equity Income Plus fund (EEIP) specifically targets dividend income above the general market average, selecting stocks that we believe meet high-quality standards.

Enhanced Income

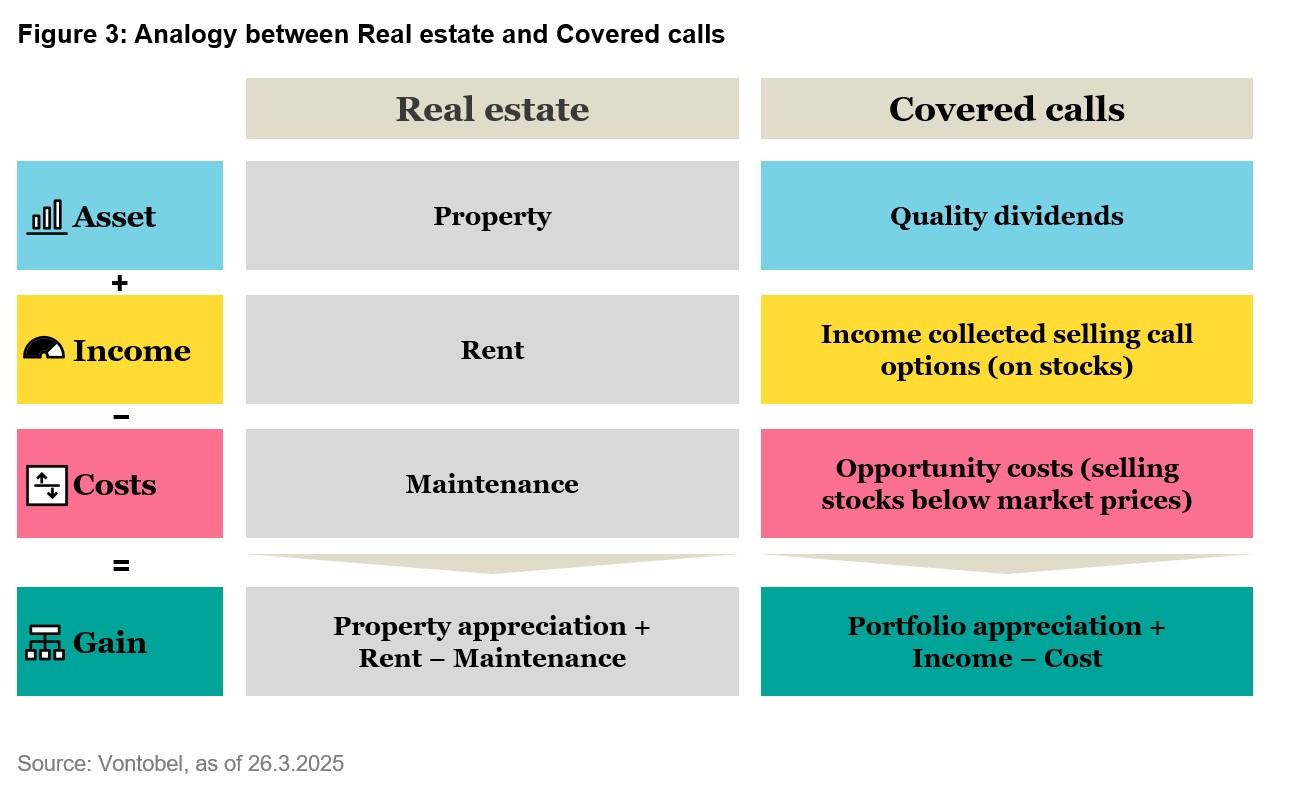

The EEIP fund aims for an annual distribution of around 7%, with roughly 60% from dividends and 40% from selling options (covered calls). Covered calls are a popular way to generate regular, additional income. Here’s how it works: by selling call options, the fund agrees to potentially sell its stocks at a pre-agreed price within a certain timeframe and receives money upfront in return. Sometimes, if the stock's price rises above this agreed price (strike price), the fund must sell the stock at this lower agreed price, missing out on some additional profits. Selling call options is like renting real estate. In real estate, the owner of the property seeks to earn extra income by renting it out. In this strategy the fund, as owner of the quality dividend portfolio, seeks to earn extra income by selling call options on individual stocks. These figures are estimates and actual income may vary, depending on market conditions. The analogy is depicted in Figure 3:

Dynamic Participation

While covered calls are straightforward in theory, successful implementation requires careful, active management—especially in rapidly changing market conditions such as sudden market downturns or rebounds. Unlike passive strategies, which follow a fixed approach and can limit gains while still exposing investors to losses, EEIP uses active management. A dynamic approach is used to handle extraordinary market conditions. This active management aims handle sharp downturns and rebounds, offering the potential of additional safeguards compared to a passive strategy.The goal is to deliver returns that meet or exceed the MSCI EMU index and provide attractive, regular income."

EEIP – A Powerful Strategy

The fund should perform well in markets that are moderately rising or moving sideways and offers some safeguards during market downturns. Investing in EEIP provides several independent sources of potential returns: stock appreciation, regular dividend payments, and additional income from the option strategy.

Dividend: A dividend is a portion of a company's earnings distributed to shareholders, typically on a regular basis (e.g., quarterly). Dividends provide investors with a stream of income in addition to any capital appreciation from owning the stock.

Covered Call: A covered call is an options strategy where an investor holds a long position in a stock and sells (writes) call options on that same stock to generate additional income. This strategy can limit the upside potential if the stock's price rises significantly, as the investor may be obligated to sell the stock at the strike price.

Strike Price: The strike price is the set price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset. It is a critical component in determining the value and profitability of an option.

MSCI EMU: The MSCI EMU (European Economic and Monetary Union) Index is a stock market index that measures the performance of large and mid-cap companies across developed countries in the Eurozone. It serves as a benchmark for investors seeking exposure to the Eurozone equity markets.

Distribution policy of a fund defines the dividend distribution for its share classes to investors. Accumulating share classes reinvest the income received from the fund holdings back into the fund and do not distribute to shareholders. Distributing shares typically make cash payments to shareholders on a periodic basis.

Index is a portfolio that holds a broad range of securities, based on pre-defined rules. Indexes such as the FTSE 100 or DAX 30are used to represent the performance of particular markets and thus act as a reference point for performance measurement of other portfolios. An index used as reference for performance comparisons, is called a "reference index".

Information ratio is a measurement of portfolio returns in excess of the reference index per unit of return volatility. It is used to measure a portfolio manager's ability to generate excess returns relative to a reference index.

Option is a derivative, financial instrument whose price derives from the value of underlying securities, like stocks. Call/put options give buyers the right (but not the obligation) to buy/sell an underlying asset at an agreed price and date.

Volatility measures the fluctuation of a fund's performance over a certain period. It is most commonly expressed using the annualized standard deviation. The higher the volatility, the riskier a fund tends to be.

Note: The definitions provided above are based on standard financial concepts and are intended for informational purposes.

Published on 16.05.2025 CEST

ABOUT THE AUTHORS

Show more articles

Show more articlesCristiano Migliorini

Quantitative Analyst

Show more articles

Show more articlesRobert Borenich

Portfolio Manager

Show more articles

Show more articlesChams Rutkowski

Quant Analyst