Managing your wealth in the event of illness, accident or incapacity

Remain able to act with an advance care directive and powers of attorney

Published on 30.10.2025 CET

Many people place great importance on knowing that their assets are in safe hands. But what would happen if you were no longer able to make important decisions or give instructions?

If you are absent for a prolonged period, have an accident or become incapacitated, your relatives can only act on your behalf if you have made the appropriate arrangements. For instance, banking confidentiality rules prevent the disclosure of information or the acceptance of instructions without your consent.

Therefore, to ensure that your wishes regarding your assets are respected until your death, it is advisable to put some safety nets in place beforehand.

Relieve the burden associated with investment management

- Review of investment management (independently or with a delegation of investment decisions)

- Review of asset structure and complexity

What are my options if I fall ill temporarily?

If you are unable to act on your own behalf for an extended period of time—for instance, if you are staying abroad or due to illness—it may be advisable to appoint a trusted person to act on your behalf. This may include executing banking transactions for you or receiving information about your assets.

Trusted persons are designated by granting powers of attorney.

What happens if I lose capacity permanently?

In the event of permanent incapacity of judgment, adult protection measures are often necessary. If you have not established any provisions yourself, the Child and Adult Protection Authority (KESB) will appoint a legal guardian to make decisions on your behalf. This can be avoided by setting up an advance care directive in a timely manner.

If you would prefer not to leave investment decisions in the hands of relatives, you can instead delegate them to the bank by means of an investment management mandate. Have you already had the opportunity to explore our offering? Our experts will be happy to advise you on choosing a solution that fits your needs.

Another way to simplify investment management is by simplifying your asset structure. Examples of such simplification include selling properties during one’s lifetime, consolidating assets or distributing them to descendants as a lifetime gift. The transfer of assets during your lifetime can cut down on paperwork, especially for properties located abroad, as it eliminates the need to document the inheritance in accordance with foreign rules.

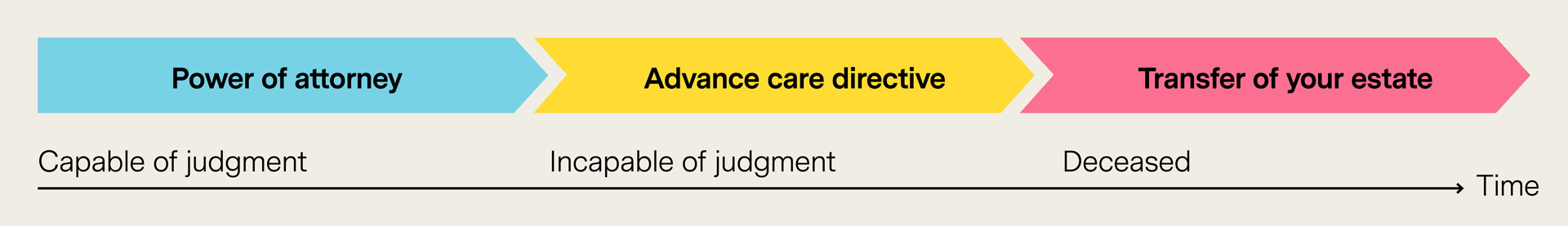

Ideally, the appointment of one or more trusted individuals in powers of attorney and in an advance care directive should form a coordinated concept together with your estate planning.

Options for your estate planning

Estate planning enables you to decide how your assets will be distributed after your death. The law sets out certain restrictions regarding compulsory portions for the surviving spouse and descendants. In order to relieve your family members from the administrative burden of administering and executing your estate during such a difficult time, we recommend appointing an executor.

The executor is responsible for the administration and distribution of the estate. In addition to relieving the burden on the heirs, having an executor means that the estate is managed without interruption or delay until the distribution. This allows for swift action if needed. Without an executor, your heirs (known as a community of heirs) must agree unanimously on all administrative decisions, no matter how trivial they may be. Furthermore, all heirs must act jointly vis-à-vis third parties. An executor, however, can perform the necessary administrative tasks independently and thus ensure that your assets are managed in accordance with your wishes until they are distributed to the heirs.

Conclusion

Making early and comprehensive provisions creates clarity in the event of an emergency and protects your assets. By setting up powers of attorney and a well-considered advance care directive, and appointing an executor, you can ensure that your assets and estate are managed smoothly and in accordance with your wishes.

Do you have any questions about powers of attorney, advance care directives or estate planning? We would be happy to provide you with personalised support. Arrange a non-binding initial consultation with our experts.