Pillar 3a: actively managed for attractive retirement planning

Published on 10.06.2025 CEST

It’s well known that simply building wealth is not enough. Ideally, it should be protected against inflation and, if possible, increased. One way to achieve this is by investing capital in securities. Given the often large amounts of capital that accumulate in pillar 3a accounts over the years, it makes sense to apply this principle to retirement provisions as well.

Why choosing a securities solution pays off in the long run

Which option offers the better potential returns? A security-oriented fixed interest account or a market-linked investment in securities?

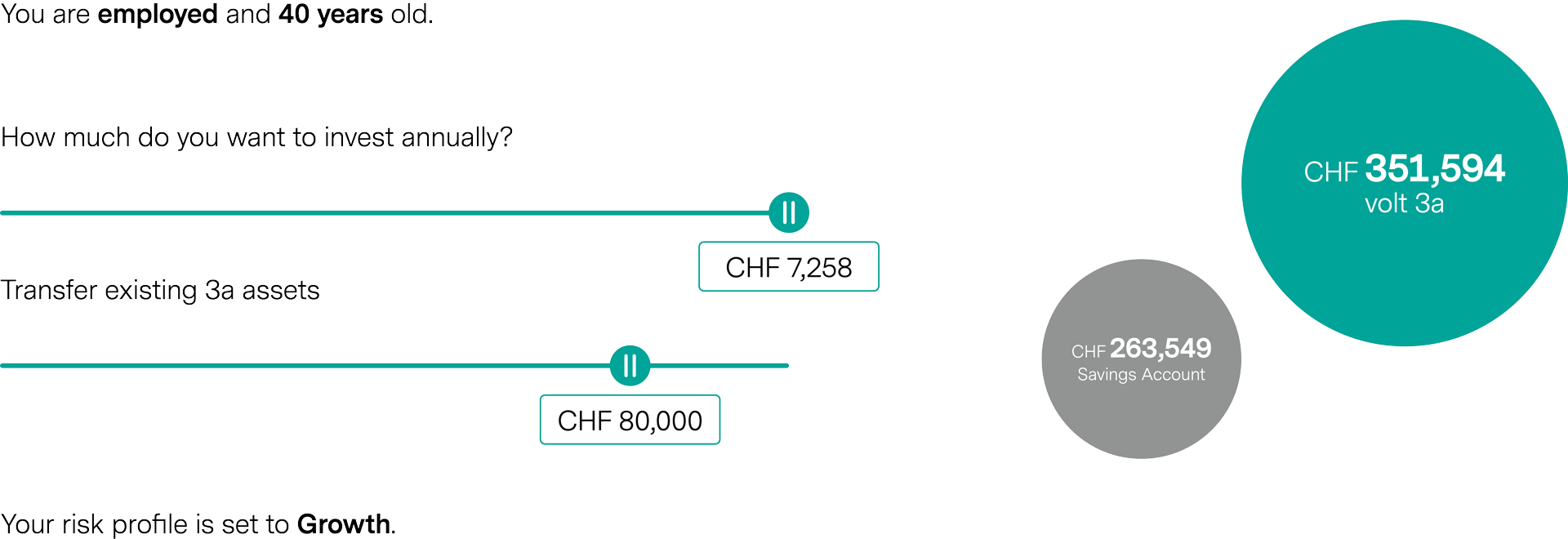

Here’s a sample calculation using our app-based investment solution, Volt 3a:

Assuming a remaining working period of 25 years, an initial capital of CHF 80,000 in your pillar 3a account, and an annual contribution of CHF 7,258.

According to the Volt 3a calculation model, a 3a securities portfolio with a “growth” investment strategy would reach an expected final asset value of around CHF 352,000. In comparison: in the same period, a savings account would yield around CHF 264,000.

Regularly investing your savings capital according to your personal investment strategy is therefore a key success factor in retirement savings.

For the self-employed, Pillar 3a offers particularly attractive opportunities. Since they are usually not affiliated with a pension fund, they can contribute significantly higher amounts up to 20 percent of their net income, but no more than the legally set maximum amount of CHF 36,288. This gives the self-employed the chance to actively close retirement gaps and reduce their tax burden. Especially for entrepreneurs with fluctuating incomes, Pillar 3a provides a flexible, tax-efficient way to build retirement capital through securities savings.

Four benefits of a securities solution

- Protection against inflation

In percentage terms, inflation is often higher than the corresponding interest rate on your account. This makes it achieving a higher return all the more important in order to preserve or even increase your capital. This can be achieved, for example, by investing in tangible assets such as stocks. - Higher long-term return potential

With a 3a solution offering a fixed interest rate, you often receive only a a low rate well below one percent. With a balanced investment strategy, a long-term return target of around 3 to 4 percent per year can be considered realistic. - Compound interest effect

Investments in securities benefit from the compound interest effect in the long term, as returns are reinvested continuously. This optimizes the returns on investment overall. - Personal risk appetite

When it comes to securities investments, an investment strategy is determined based on your personal risk appetite. This can range from a low-risk strategy to a dynamic portfolio approach. Our experts are happy to assist you in choosing the right investment option.

Planning options through additional contributions

In addition to the AHV (1st pillar) and the pension fund (2nd pillar), Pillar 3a provides extra retirement savings and insures against the risks of disability and death. Typically, the accumulated capital is withdrawn at retirement at a privileged tax rate. But Pillar 3a offers further tax advantages: annual contributions can be deducted from taxable income. Contributions can be made in the form of an account or a securities solution, or as an insurance solution combined with risk protection in the event of death or disability. Since the beginning of this year, it is also possible to make additional voluntary contributions to Pillar 3a beyond the maximum amount, allowing gaps in past contributions to be closed.

The most important questions and answers around additional Pillar 3a contributions

In 2026, you can make a retroactive additional contribution for 2025 for the first time, provided there is a contribution gap for 2025. Gaps that occurred before 2025 cannot be closed. The deadline for making a retroactive contribution is 10 years. This means, for instance, that you have until 2035 to make a retroactive contribution for the year 2025.

Employees and self-employed individuals can make additional contributions into Pillar 3a and deduct them from their income if they:

- have not paid the maximum permitted contributions in all of the ten years prior to the additional contribution;

- earned income subject to AHV in the years when the maximum contribution was not made;

- have already fully paid the maximum regular contribution in the year the additional contribution is to be made; and

- have not yet withdrawn any assets from Pillar 3a.

The maximum annual contribution amount corresponds to the maximum allowable regular contribution to Pillar 3a (for 2026: CHF 7,258). If there is a contribution gap, an additional amount we recommend planning purchases tailored to the individual situation paid in on top of the regular contribution. This allows up to CHF 14,516 to be paid into Pillar 3a in one year.

Example: In both 2025 and 2026, only CHF 1’000 each is contributed to Pillar 3a, instead of the maximum CHF 7’258, resulting in a cumulative gap of CHF 12’516. To partially close this gap in 2027, CHF 7’258 can be contributed as a regular payment and another CHF 7’258 can be contributed as an additional payment, both deductible from income. The remaining gap of CHF 5’258 expires and can no longer be closed afterwards.

For an optimal contribution strategy, we recommend planning payments tailored to the individual situation.

No, the contributions can be made to different pension foundations.

Yes, contributions to occupational and private pension plans can be made in the same year.

No, after the first withdrawal from a Pillar 3a account, usually no earlier than five years before reaching the AHV reference age, no further contributions can be made, even if there are still contribution gaps.

It is therefore advisable to individually assess whether future withdrawals should continue to be made in a staggered manner.

A written request for the voluntary contribution must be submitted to the pension institution. The foundation will subsequently request the necessary information and documents to review the application. The voluntary contribution can only be made once the application has been reviewed and approved by the foundation.

Three tax tips relating to 3a contributions

- If you receive a salary abroad, you may be able to deduct only part or none of your Pillar 3a contributions, as the deduction is allocated proportionally to your domestic and foreign income. Since it is now possible to retroactively close contribution gaps in Pillar 3a, it may be sensible to wait until you are earning a higher domestic income before doing so. The reason: tax advantages.

- If you make a voluntary contribution into your occupational pension fund, you are generally not allowed to withdraw capital within the next three years (statutory lock-in period). Otherwise, the voluntary contribution will not be recognised for tax purposes and will be retroactively adjusted. During this period, for tax reasons—and besides investments in real estate—it may be beneficial to close any existing Pillar 3a gap. Please note that after a withdrawal from Pillar 3a due to retirement, no further contributions are possible. Therefore, staggered withdrawals from Pillar 3a should be reassessed in light of possible future voluntary contributions.

- In a low-income year, for instance as a student or part-time employee, it may be worthwhile to allow a gap to form in Pillar 3a contributions and close it in a higher-income year.

Conclusion

Selecting an investment strategy aligned with your individual risk tolerance is essential to fully leverage the tax benefits, optimize long-term growth, and safeguard your assets against inflation. We invite you to consult our pension experts, who are dedicated to providing personalized guidance to secure your financial future with confidence and precision.

Published on 10.06.2025 CEST

ABOUT THE AUTHORS

Show more articles

Show more articlesMichael Eugster

Senior Financial Planner

Show more articles

Show more articlesClaude Frosio

Head Tax Consulting