Strategies to tackle the top 3 risks in global equity markets

Published on 30.04.2025 CEST

Investors may be searching for signs of clarity, but we believe uncertainty and volatility are here to stay. Tariffs will have a significant impact on the global economy and their effects will take time to play out.

In our view, the Quality Growth philosophy rooted in predictability and its balanced construction approach leaves investors well positioned to weather the uncertainty of 2025, and the longer-term market cycles. We can see how our portfolios are positioned for resilience by diving into the three main drivers of the sobering sentiment: 1. Trump 2.0 and tariff-related uncertainty, 2. a softening macro backdrop, and 3. AI evolution and disruption. Our Quality Growth portfolios have limited exposure to the most potentially impacted industries, while having significant exposure to industries that we believe may have limited downside.

1. Trump 2.0 and tariffs – a moving target with real impact

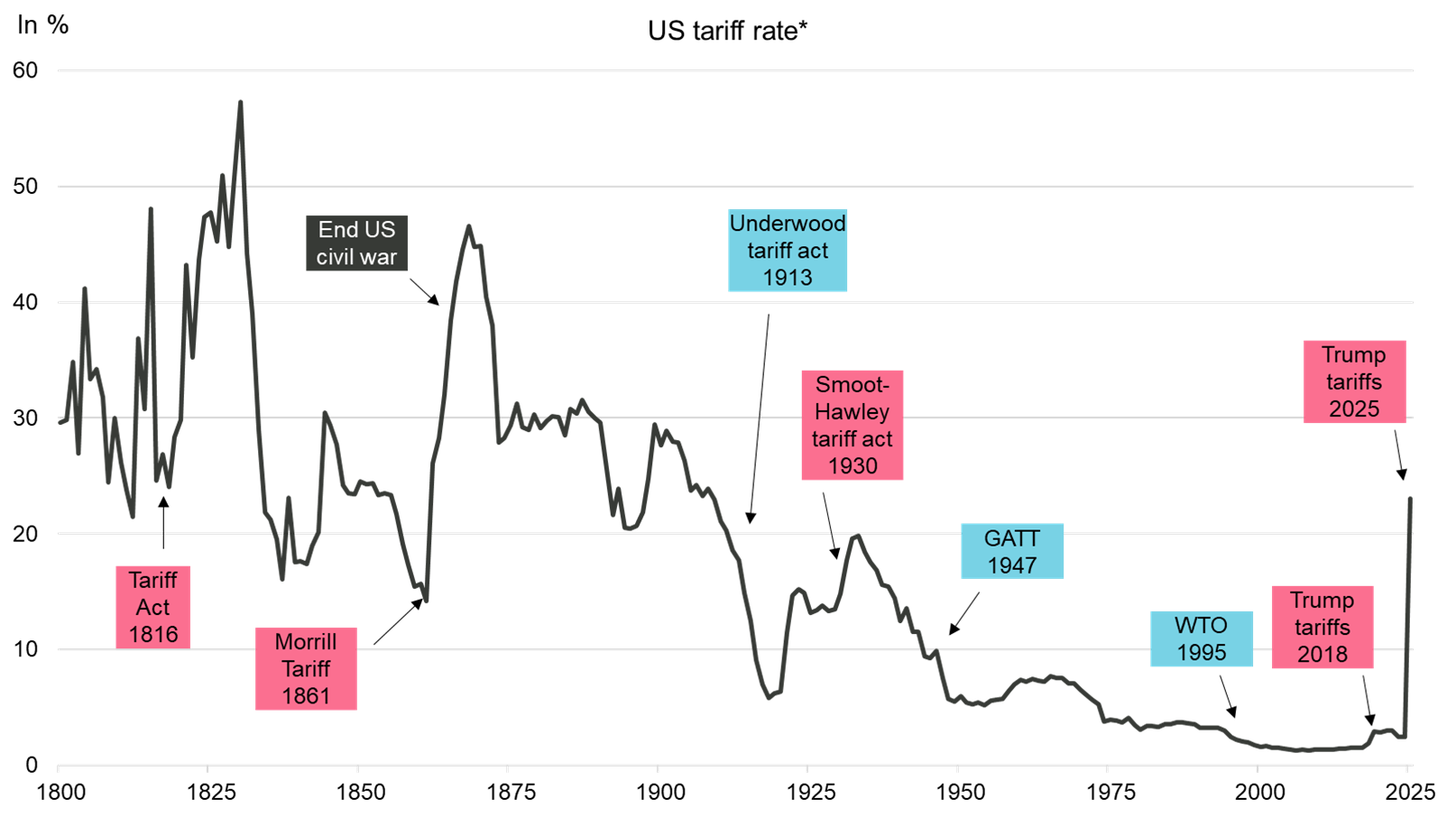

Investors were aware of the Trump administration’s promises of tariffs; however, the announcements on April 2, 2025, “Liberation Day,” took markets by surprise. President Trump announced reciprocal tariffs on a long list of countries, bringing the average effective tariff rate to approximately 25%, the highest level in over 100 years. The news resulted in a sharp selloff, wiping away trillions in market value in the subsequent trading days.

While the tariff conversation is still somewhat of a moving target as various countries attempt negotiations, we believe significant tariffs are here to stay as the President has remained consistent in his views, believing that the post World War II regime of globalization and free trade has decimated US manufacturing. As such, he views tariffs, while a blunt measure, the best way to right this perceived wrong.

Figure 1: The effective U.S. tariff rate is expected to (temporarily) move to a 100-year high

*The tariff rate is the customs duty revenue as a percent of dutiable imports

Source: Historical Statistics of the United States Ea424-434, BEA, Bloomberg estimates, Vontobel

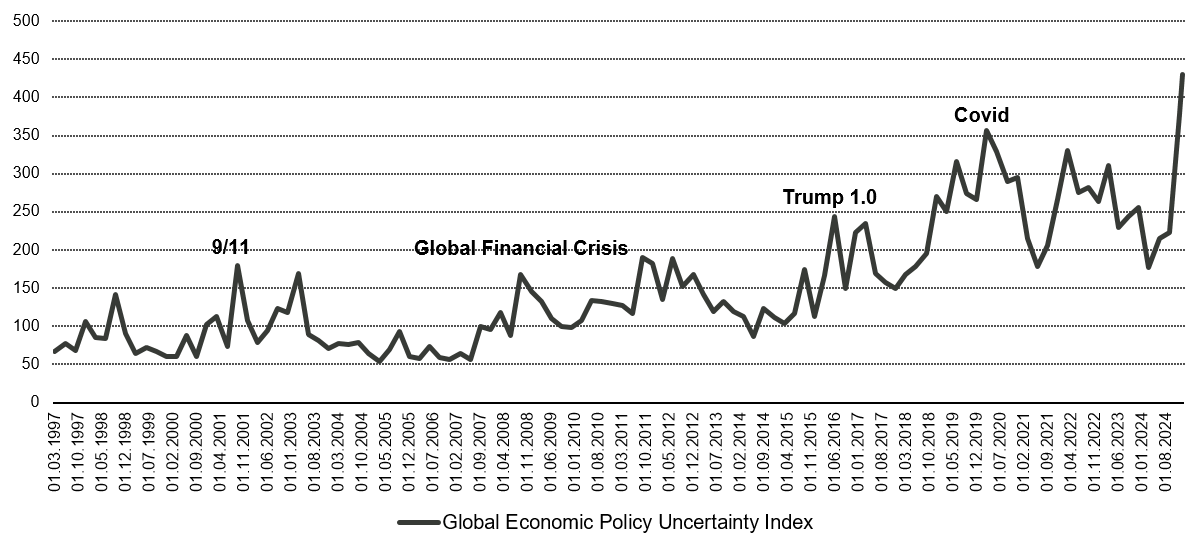

This has subsequently increased the level of trade policy uncertainty, bringing global economic policy uncertainty to a record level, even above what was experienced during Covid, 9/11, or the Global Financial Crisis, as measured by the Bloomberg Global Economic Policy Uncertainty Index (See Figure 2).

And while “Liberation Day” provided some directional insight, it has not provided the clarity investors were hoping for, meaning that uncertain sentiment is likely to be the new normal.

Figure 2: Trump 2.0 has created increased uncertainty

Source: Bloomberg, Baker, Bloom & David, as of 31 March 2025.

That said, the impact of tariffs will likely not be uniform across industries. We expect cyclical and capital-intensive industries, such as autos, oil and gas, and airlines, to be most negatively impacted. Our Quality Growth portfolios typically have less exposure to these industries given our ongoing focus on companies with low capital intensity, high pricing power, and limited competition. Service-oriented businesses tend to possess these characteristics and may not be substantially affected by tariffs given they are free of import constraints. As a result, Quality Growth tends to favor such investments.

The luxury goods industry also tends to be relatively insulated from negative tariff impacts given its structure and target demographic. While luxury goods companies may rely on imports, they cater to the least impacted segment of the population – high-income consumers, who are typically less price sensitive.

2. Softening macro backdrop

While investors brushed off the prospect of a recession in 2023 and 2024, the environment of heightened uncertainty in 2025 has made investors look twice at potential cracks in the macro. Growing policy uncertainty has weighed on consumer confidence. After “Liberation Day”, sentiment worsened further given tariffs were much higher than anticipated, pushing up prices of everyday consumer goods. While data appears strong overall, the lower-end consumer remains under pressure, as in 2024, with this group projected to be the most impacted by higher prices tied to tariffs. The market sell off has also impacted the higher end consumer given it is this demographic that holds a significant percentage of equity ownership. At the corporate level, this is set to weigh on both volumes and margins making 2025 earnings expectations seem unrealistic. In addition, investors are closely watching the labor market, particularly the impact of job cuts related to DOGE on employment and the broader economy.

This has resulted in a downward revision in GDP and an increase in the odds of a recession, ranging from 40-60% depending on the source. While we do not make such predictions as bottom-up investors, we do believe the impact of uncertainty and tariffs will be meaningful and will weigh on economic growth. Given our emphasis on predictability and stability, we believe that the earnings of our companies are more likely to materialize in different economic environments; however, in our view this is more amplified during times of slowdown or recession.

3. AI evolution and disruption: playing the changing AI game

Much of the exuberant environment in 2023 and 2024 was driven by the prospect of immense possibilities tied to large language models (LLMs), which drove the stock prices of perceived AI beneficiaries through the roof. During this time, the pick and shovel companies, such as Nvidia, received the most attention given their key role in the AI value chain. Until very recently, Nvidia offered the leading sophisticated GPU chips, which were viewed as a necessary input into advanced LLMs. While we believe AI will unlock tremendous opportunity, we believe that Nvidia lacked the predictability in earnings growth we seek at Quality Growth, given its current business model and state of the industry. While the growth prospects are large, earnings growth is dependent on Nvidia continuing to offer the “golden” chip solution and tremendous amounts of AI spending. Given advancements in AI are rapid and disruption in technology is the norm, we believed earnings were impossible to understand, which posed an investment risk given where valuations stood. That said, as uncertainty continues to drive market volatility, we are closely monitoring the landscape for attractive entry points into opportunistic names that we previously deemed too richly valued.

To capitalize on the growth opportunity tied to the AI evolution, we focused our attention on more predictable businesses, typically software businesses that continue to embed AI capabilities into their product offering to help customers drive efficiencies. We believe these players can continue to benefit from AI tailwinds, while also offering more predictable and sustainable streams of earnings growth given their existing businesses are well established, diverse, and not dependent on AI evolving in one specific way.

The LLMs released by Chinese start-up DeepSeek highlighted the vulnerability of pick and shovel companies as the threat of lower spending requirements for industry leading AI models posed significant challenges to the providers of such chips. Investors were quick to abandon the prior AI darling, and Nivida shed almost USD 600 billion in market capitalization in just a few hours. During this time, software and services type companies have been relatively resilient. Ultimately, the long-term winners of AI remain unknown, however we continue to gain exposure to growth opportunities through avenues with greater transparency, predictability, and resilience, such as professional services, consulting, and software businesses.

Built for resilience

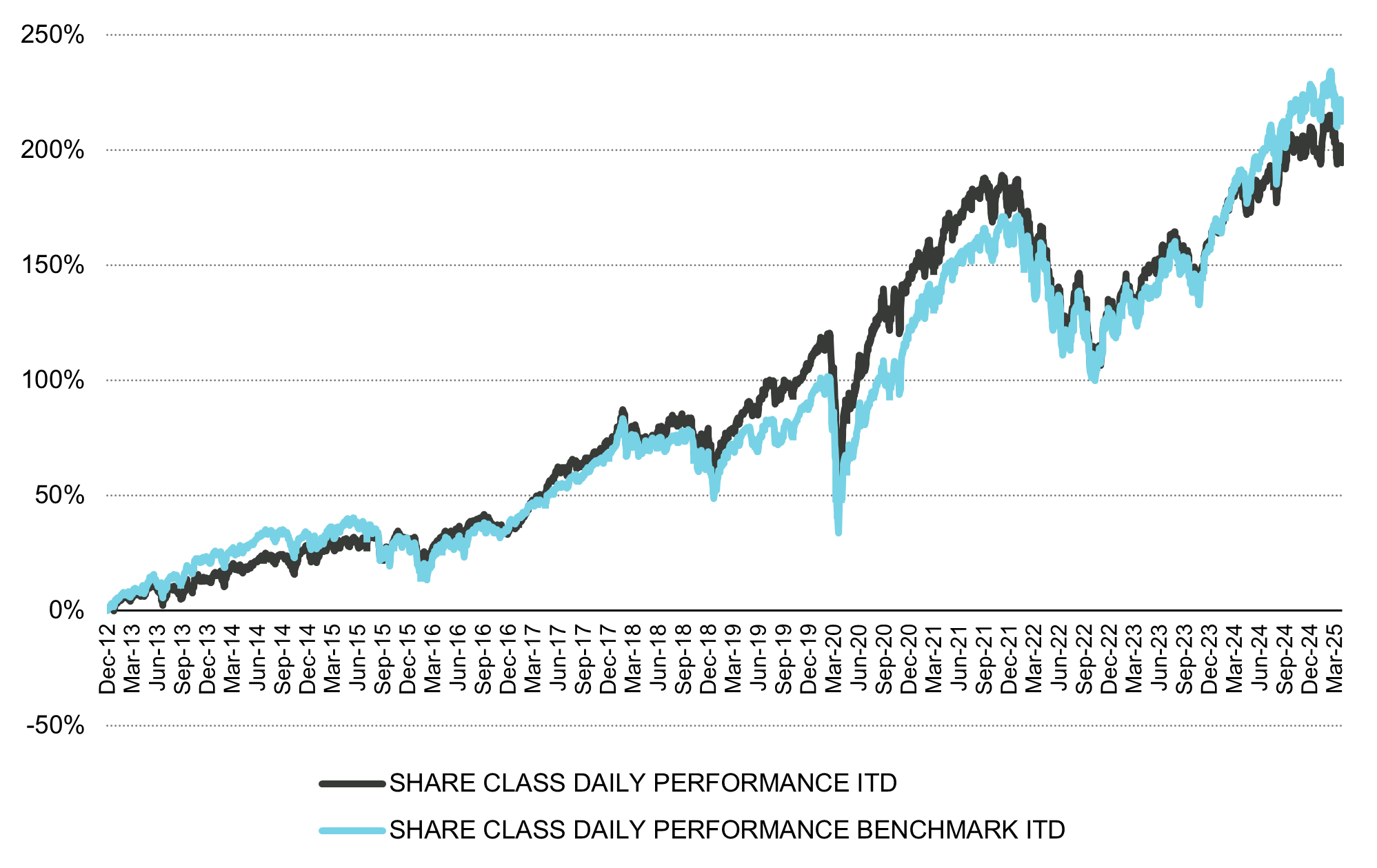

Our approach aims to deliver outperformance over the market cycle. While we cannot predict the twists and turns of the markets, we believe that our emphasis on predictability, durability, and resilience may help investors compound capital over the long term. And while this may mean relative performance can trail in strong equity market rallies, our value proposition of minimizing downside exposure and volatility should enable our portfolios to shine in times of uncertainty or turbulent environments, such as the one created by Trump 2.0.

Figure 3: Vontobel Fund – Global Equity, Cumulative performance (net returns, in %)

As of 31.3.2025 (N-Share class)

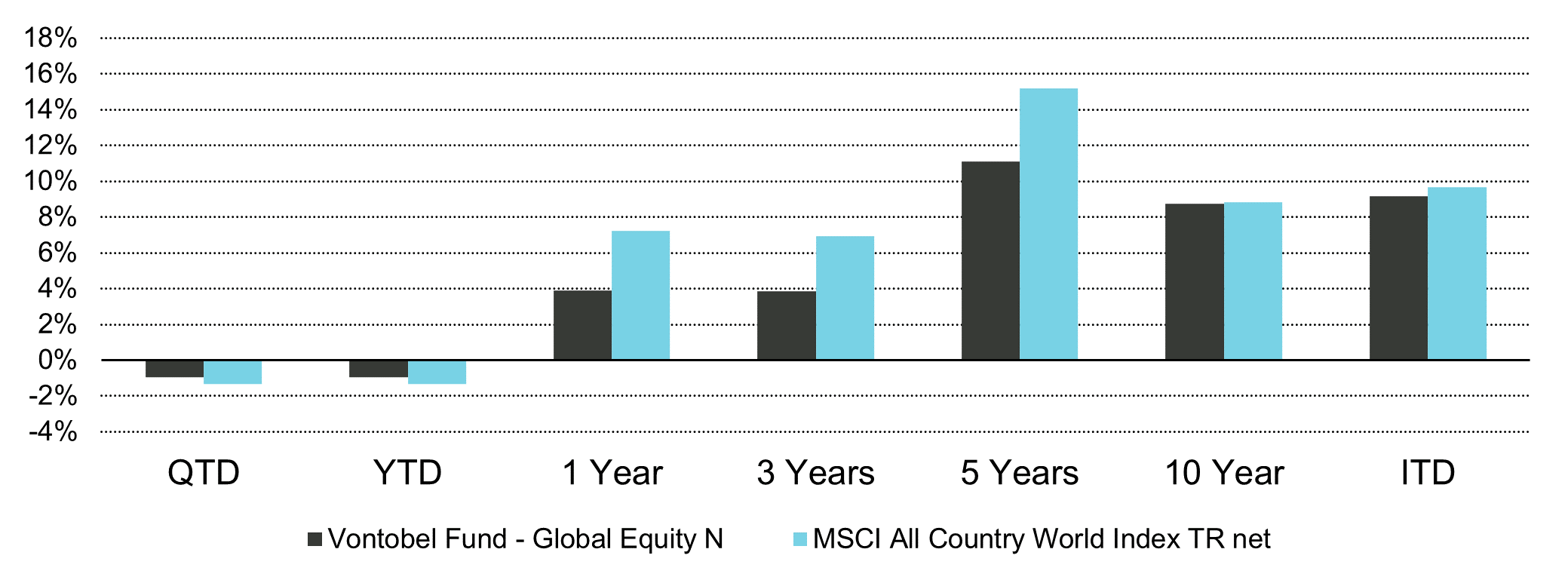

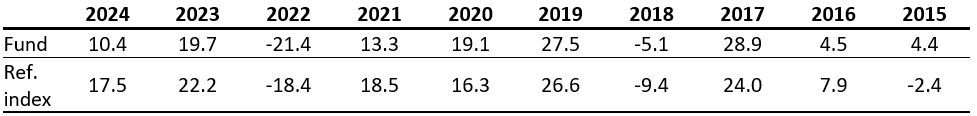

Figure 4: Vontobel Fund – Global Equity, Historical performance (net returns, in %)

As of 31.3.2025 (N-Share class)

Past performance is not a reliable indicator of current or future performance. Performance data does not take into account any commissions and costs charged when shares of the fund are issued and redeemed, if applicable. The return of the fund may go down as well as up, e.g. due to changes in rates of exchange between currencies. Performance and characteristics for other share classes will differ from the information discussed herein.

Fund characteristics

Share class: Vontobel Fund - Global Equity N (ISIN LU0858753451)

Reference index: M SCI World Index to 31.12.2010, M SCI ACWI thereafter

Currency: USD

Inception date: 19.6.2008

Reporting period: 19.6.2008-31.3.2025

Investment risks1

A company's stock price may be adversely affected by changes in the company, its industry or economic environment and prices can change quickly. Equities typically involve higher risks than bonds and money market instruments.

The sub-fund’s investments may be subject to sustainability risks. The sustainability risks that the sub-fund may be subject to are likely to have an immaterial impact on the value of the sub-fund’s investments in the medium to long term due to the mitigating nature of the sub-fund’s ESG approach. The sub-fund’s performance may be positively or negatively affected by its sustainability strategy. The ability to meet social or environmental objectives might be affected by incomplete or inaccurate data from third-party providers. Information on how environmental and social objectives are achieved and how sustainability risks are managed in this sub-fund may be obtained from vontobel.com/sfdr.

1 The listed risks concern the current investment strategy of the fund and not necessarily the current Portfolio. Subject to change, without notice, only the current prospectus or comparable document of the fund is legally binding.

Important legal information

This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell shares of the fund/fund units or any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever. Subscriptions of shares of the fund should in any event be made solely on the basis of the fund’s current sales prospectus (the “Sales Prospectus”), the Key (Investor) Information Document (“K(I)ID”), its articles of incorporation and the most recent annual and semi-annual report of the fund and after seeking the advice of an independent finance, legal, accounting and tax specialist. This document is directed only at recipients who are institutional clients, such as eligible counterparties or professional clients as defined by the Markets in Financial Instruments Directive 2014/65/EC (“MiFID”) or similar regulations in other jurisdictions, or as qualified investors as defined by Switzerland’s Collective Investment Schemes Act (“CISA”).

Neither the fund, nor the Management Company nor the Investment Manager make any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of an assessment of ESG research and the correct execution of the ESG strategy. As investors may have different views regarding what constitutes sustainable investing or a sustainable investment, the fund may invest in issuers that do not reflect the beliefs and values of any specific investor.

Past performance is not a reliable indicator of current or future performance.

Performance data does not take into account any commissions and costs charged when shares of the fund are issued and redeemed, if applicable. The return of the fund may go down as well as up, e.g. due to changes in rates of exchange between currencies. The value of the money invested in the fund can increase or decrease and there is no guarantee that all or part of your invested capital can be redeemed.

Interested parties may obtain the above-mentioned documents free of charge from the authorized distribution agencies and from the offices of the fund at 49 Avenue J.F. Kennedy, L-1855 Luxembourg, the facilities agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Am Belvedere 1, A-1100 Vienna, the representative in Switzerland: Vontobel Fonds Services AG, Gotthardstrasse 43, 8022 Zurich, the paying agent in Switzerland: Bank Vontobel AG, Gotthardstrasse 43, 8022 Zurich, the European facilities agent for Germany: PwC Société coopérative - GFD, 2, Rue Gerhard Mercator B.P. 1443, L-1014 Luxembourg, Email: lu_pwc.gfd.facsvs@pwc.com, gfdplatform.pwc.lu/facilities-agent/, the information agent in Liechtenstein: LLB Fund Services AG, Äulestrasse 80, FL-9490 Vaduz. Refer for more information on the fund to the latest prospectus, annual and semi-annual reports as well as the key (investor) information documents (“K(I)ID”). These documents may also be downloaded from our website at vontobel.com/am. A summary of investor rights (including information on representative actions for the protection of the collective interests of consumers under EU Directive 2020/1828) is available in English under: vontobel.com/vamsa-investor-information. Vontobel may decide to terminate the arrangements made for the purpose of marketing its collective investment schemes in accordance with Article 93a of Directive 2009/65/EC. Denmark: The KID is available in Danish. Finland: The KID is available in Finnish. The KID is available in French. The fund is authorized to the commercialization in France. Refer for more information on the funds to the KID. Italy: Refer for more information regarding subscriptions in Italy to the Modulo di Sottoscrizione. For any further information: Vontobel Asset Management S.A., Milan Branch, Piazza degli Affari 2, 20123 Milano, telefono: 0263673444, e-mail: clientrelation.it@vontobel.com. Netherlands: The Fund and its sub-funds are included in the register of Netherland's Authority for the Financial Markets as mentioned in article 1:107 of the Financial Markets Supervision Act (“Wet op het financiële toezicht”). Norway: The KID is available in Norwegian. Please note that certain sub-funds are exclusively available to qualified investors in Andorra or Portugal. In Spain, funds authorized for distribution are recorded in the register of foreign collective investment companies maintained by the Spanish CNMV (under number 280). The KID can be obtained in Spanish from Vontobel Asset Management S.A., Sucursal en España, Paseo de la Castel-lana, 91, Planta 5, 28046 Madrid. Sweden: The KID is available in Swedish. The fund and its sub-funds are not available to retail investors in Singapore. Selected sub-funds of the fund are currently recognized as restricted schemes by the Monetary Authority of Singapore. These sub-funds may only be offered to certain prescribed persons on certain conditions as provided in the “Securities and Futures Act”, Chapter 289 of Singapore. This document was approved by Vontobel Pte. Ltd., which is licensed with the Monetary Authority of Singapore as a Capital Markets Services Licensee and Exempt Financial Adviser and has its registered office at 8 Marina Boulevard, Marina Bay Financial Centre (Tower 1), Level 04-03, Singapore 018981. This advertisement has not been reviewed by the Monetary Authority of Singapore. The fund is not authorized by the Securities and Futures Commission in Hong Kong. It may only be offered to those investors qualifying as professional investors under the Securities and Futures Ordinance. The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution and if you are in doubt about any of the contents of this document, you should obtain independent professional advice. This document was approved by Vontobel (Hong Kong) Ltd., which is licensed by the Securities and Futures Commission of Hong Kong and provides services only to professional investors as defined under the Securities and Futures Ordinance (Cap. 571) of Hong Kong and has its registered office at 1901 Gloucester Tower, The Landmark 15 Queen’s Road Central, Hong Kong. This advertisement has not been reviewed by the Securities and Futures Commission.The fund authorised for distribution in the United Kingdom and entered into the UK’s temporary marketing permissions regime can be viewed in the FCA register under the Scheme Reference Number 466625. The fund is authorised as a UCITS scheme (or is a sub fund of a UCITS scheme) in a European Economic Area (EEA) country, and the scheme is expected to remain authorised as a UCITS while it is in the temporary marketing permissions regime. This information was approved by Vontobel Asset Management S.A., London Branch, which has its regis-tered office at 3rd Floor, 70 Conduit Street, London W1S 2GF and is authorized by the Commission de Surveillance du Secteur Financier (CSSF) and subject to limited regulation by the Financial Conduct Authority (FCA). Details about the extent of regulation by the FCA are available from Vontobel Asset Management S.A., London Branch, on request. The KIID can be obtained in English from Vontobel Asset Management S.A., London Branch, 3rd Floor, 70 Conduit Street, London W1S 2GF or downloaded from our website vontobel.com/am.

This document is not the result of a financial analysis and therefore the “Directives on the Independence of Financial Research” of the Swiss Bankers Association are not applicable. Vontobel and/or its board of directors, executive management and employees may have or have had interests or positions in, or traded or acted as market maker in relevant securities. Furthermore, such entities or persons may have executed transactions for clients in these instru-ments or may provide or have provided corporate finance or other services to relevant companies.

The MSCI data is for internal use only and may not be redistributed or used in connection with creating or offering any securities, financial products or indices. Neither MSCI nor any other third party involved in or related to compiling, computing or creating the MSCI data (the “MSCI Parties”) makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and the MSCI Parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to such data. Without limiting any of the foregoing, in no event shall any of the MSCI Parties have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

Although Vontobel believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this document. Except as permitted under applicable copyright laws, none of this information may be reproduced, adapted, uploaded to a third party, linked to, framed, performed in public, distributed or transmitted in any form by any pro-cess without the specific written consent of Vontobel. To the maximum extent permitted by law, Vontobel will not be liable in any way for any loss or damage suffered by you through use or access to this information, or Vontobel’s failure to provide this information. Our liability for negligence, breach of contract or contravention of any law as a result of our failure to provide this information or any part of it, or for any problems with this information, which cannot be lawfully excluded, is limited, at our option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. Neither this document nor any copy of it may be distributed in any jurisdiction where its distribution may be restricted by law. Persons who receive this document should make themselves aware of and adhere to any such restrictions. In particular, this docu-ment must not be distributed or handed over to US persons and must not be distributed in the USA.

Vontobel

Gotthardstrasse 43, 8022 Zurich

Telefon +41 58 283 71 50

Telefax +41 58 283 71 51

vontobel.com/am

Published on 30.04.2025 CEST