Rediscover returns

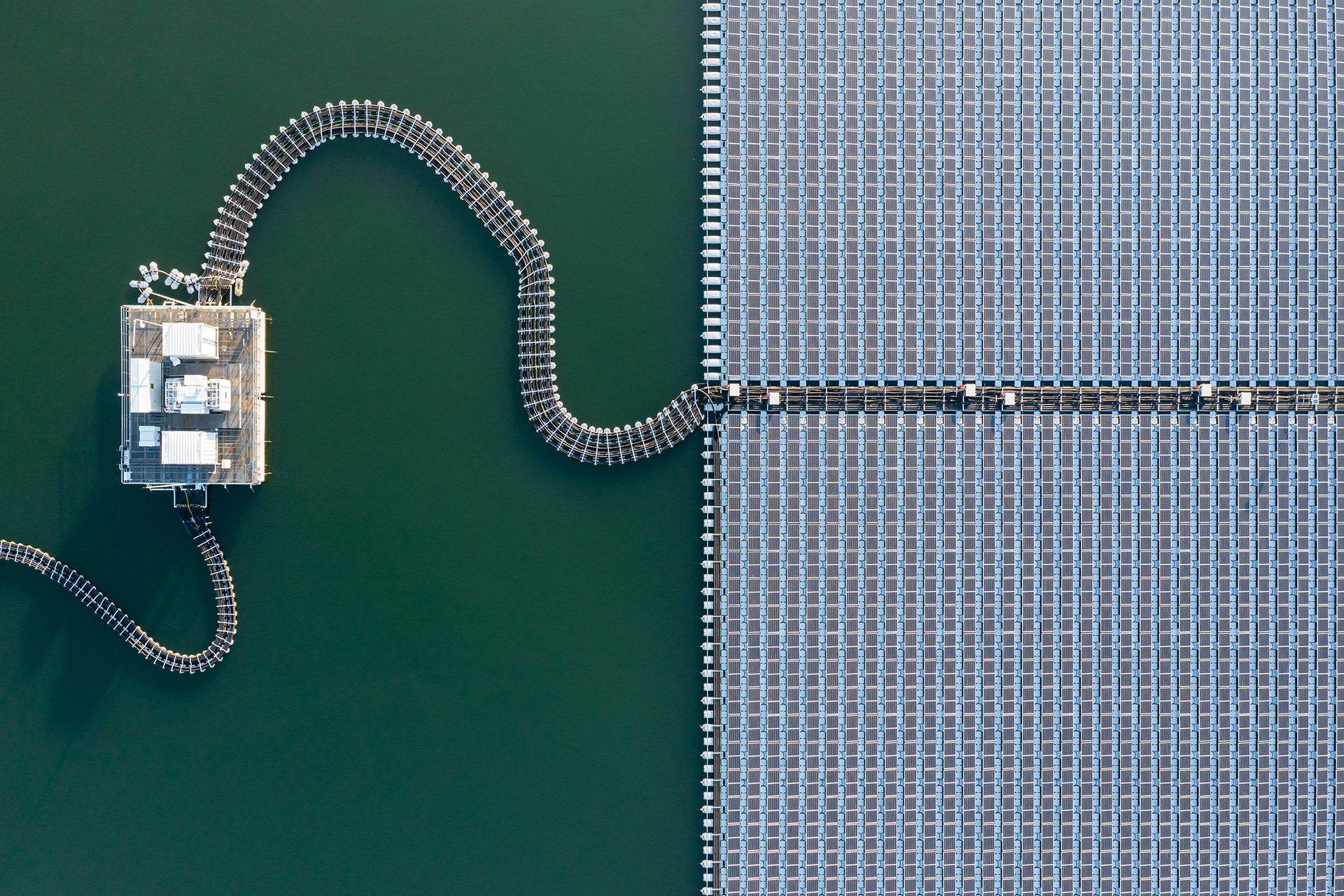

Discover a world of crisis-tested sources of income

Financial markets are very good at anticipating and pricing in economic developments—but they are not so good at looking at uncertainties in a matter-of-fact way. This is particularly evident when the world is turned upside down. The last few years have been eventful in this regard: With the pandemic, wars, geopolitical tensions and an emerging AI revolution, emotional investors have fueled the ups and downs in the markets. How do investors defend the profitability of their portfolios in times like these?

By actively working to balance the advantages and disadvantages of asset classes, investment styles and market regions, for example.

Time to rediscover sources of returns

If you would like to learn more about steady streams of income in an investment context, please contact us.

A brave new world

Since the 2008 financial crisis, investors have only known one market environment—one shaped by low interest rates and loose monetary policy. However, a look at the preceding decades tells us that this stable environment by no means reflects a “normal state” for the financial markets. Quite the opposite, in fact.

Between 1970 and 2000, the US Federal Reserve’s base rate was largely around five percent. Investors had to navigate a climate of prolonged high interest rates shaped by a polarized world order and, until the 1990s, geopolitical tensions on a global scale.

Although the underlying factors of these decades may not be comparable to those of today, certain parallels can be drawn when it comes to market dynamics in the high interest rate environment. This not only gives business historians something to talk about, it also provides investors with the opportunity to rediscover new return potential in familiar asset classes.