Building, securing and passing on wealth

Plan your wealth

We work with you to develop a comprehensive strategy based on your individual financial and family situation as well as your personal wishes and goals.

Whether for your career, retirement, or estate: Anticipating decisive moments in life is essential not only for establishing financial security, but also for achieving your goals. We guide you in making forward-looking decisions and meticulously structuring your wealth—tailored, goal-driven and far beyond investing.

What are your goals?

We are here to help you turn your future aspirations into reality.

How can Wealth Planning help you?

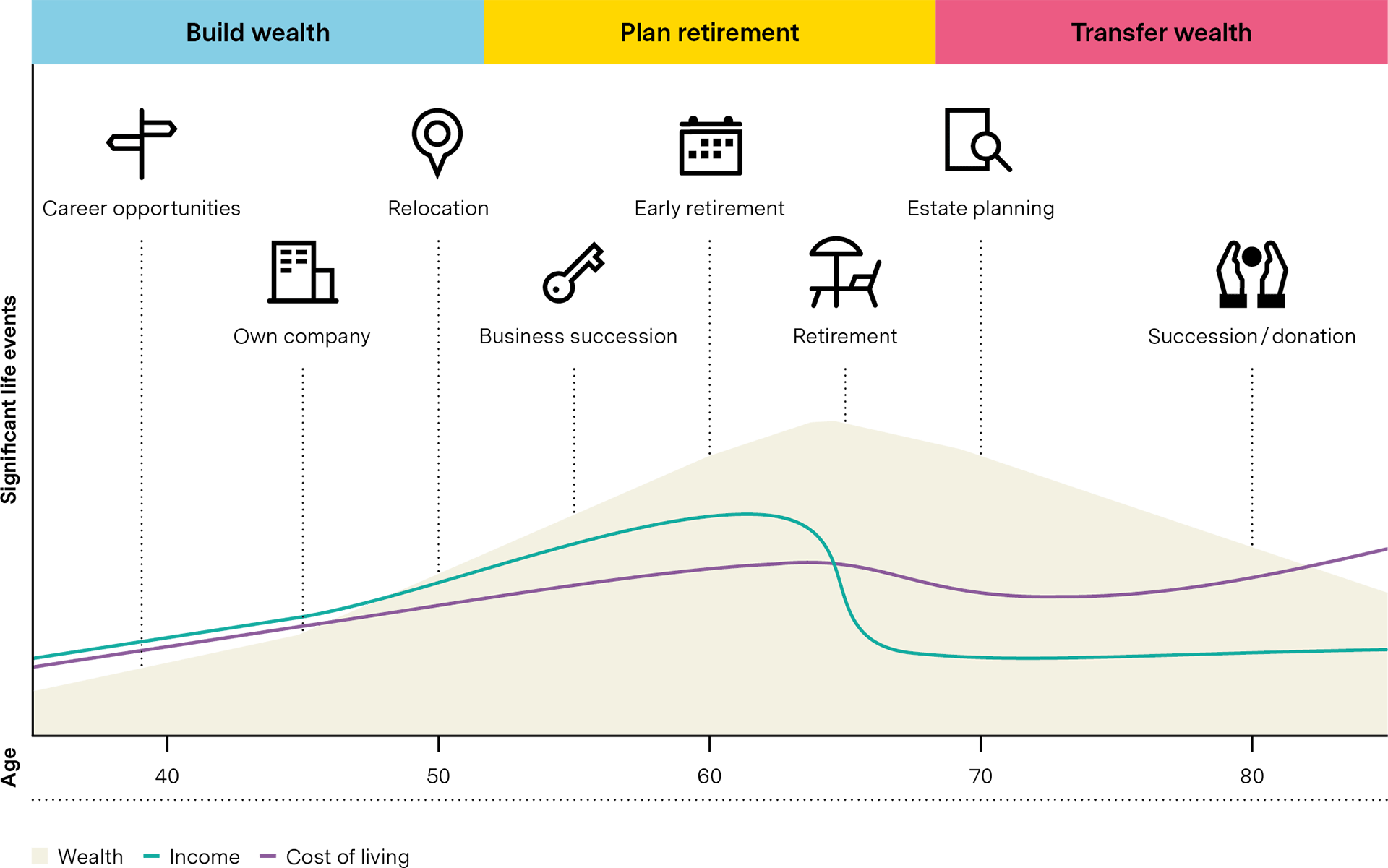

Wealth Planning focuses on three key areas: building wealth to help you achieve your financial goals, planning for retirement to ensure you can maintain your standard of living after you retire, and making provisions for your loved ones. Wealth Planning can play an important role in shaping your financial future during key life events.

*The initial consultation is suitable for people who have multiple sources of assets, property, and/or pension plans, who wish to assess their overall situation and identify potential optimizations as well as get investment ideas. The duration of the free initial consultation is 60 minutes.

We guide you along the journey to your goals

We collaborate with you to develop a tailored solution that reflects your goals and expectations.

1.

Initial consultation

Focus on your current situation

2.

Strategy development

Shaping your perspectives

3.

Professional expertise

Targeted involvement of specialists

4.

Implementation

Realizing your solutions

In safe hands

Vontobel has decades of experience in supporting clients with complex wealth planning question, offering expertise and foresight with the aim to provide more than investment solutions. Our team of experienced specialists is here to assist you.